The Mortgage Bankers Association on Monday promoted Jamie Woodwell to Senior Vice President of Commercial/Multifamily Policy and Strategic Industry Engagement. Woodwell, a 20-year veteran at MBA, will oversee the association’s public policy and member engagement efforts across all commercial real estate finance sectors, working closely with member leaders and staff to advance MBA members’ business and policy objectives.

Tag: Jamie Woodwell

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased $47.7 Billion in Third Quarter

The level of commercial/multifamily mortgage debt outstanding increased by $47.7 billion (1%) in the third quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

MBA: Commercial Mortgage Delinquency Rates Increase in Third Quarter

Commercial mortgage delinquencies increased in the third quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

Commercial, Multifamily Mortgage Delinquency Rates Increase in Third Quarter

Delinquency rates for mortgages backed by commercial properties increased slightly during the third quarter of 2024.

Commercial Mortgage Delinquency Rates Increased in the Second Quarter of 2024

Commercial mortgage delinquencies increased in the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

MBA: Delinquency Rates for Commercial Property Loans Declined Slightly in Second Quarter of 2024

Delinquency rates for mortgages backed by commercial properties declined slightly during the second quarter of 2024. This is according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance Loan Performance Survey.

Commercial and Multifamily Mortgage Debt Outstanding Increased in First Quarter: MBA

The level of commercial/multifamily mortgage debt outstanding increased by $40.1 billion (0.9%) in the first quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

MBA: Commercial Mortgage Delinquency Rates Increased in First Quarter

Commercial mortgage delinquencies increased in the first quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

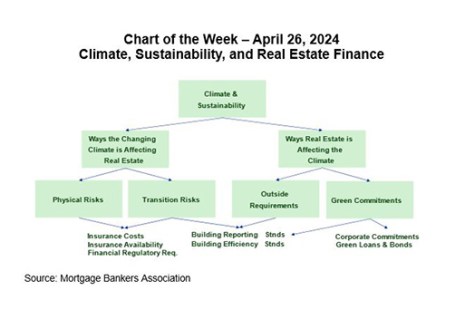

MBA Chart of the Week: Climate, Sustainability and Real Estate Finance

With Earth Day happening this month, it seems an opportune time to discuss the intersection of climate/sustainability issues and real estate finance. MBA has been leading on these issues for more than half a decade, helping members through our work related to research, policy and practice.

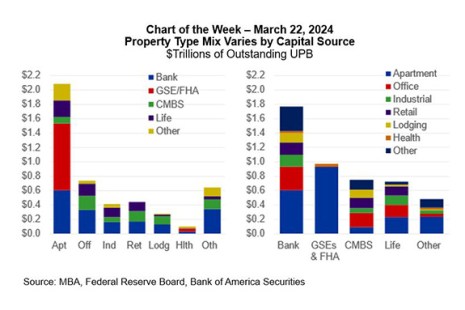

MBA Chart of the Week: CRE Mortgage Debt Across Capital Sources, Property Types

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.