Early January mortgage rate declines unlocked refinance opportunities for nearly five million borrowers and helped push affordability to a four-year high, according to ICE Mortgage Technology, Atlanta.

Tag: ICE Mortgage Monitor

ICE Mortgage Monitor: Property Insurance Costs Continue to Grow

ICE Mortgage Technology, Atlanta, released its ICE Mortgage Monitor Report, highlighting a continued surge in property insurance costs.

ICE Mortgage Monitor Finds Some Early Signs of Stress for Homeowners

ICE Mortgage Technology, Atlanta, released its July 2025 Mortgage Monitor report, finding that there are early signs of financial stress emerging among subsets of homeowners.

ICE Mortgage Monitor: Record Levels of Home Equity, Falling Rates Drive Highest HELOC Withdraws Since 2008

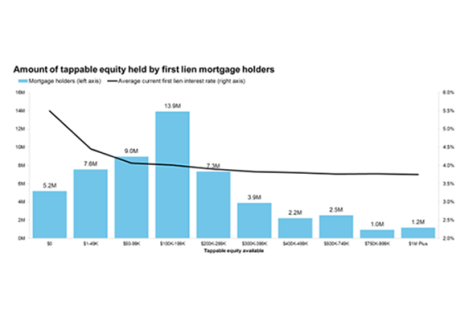

U.S. mortgage holders carried a record $17.6 trillion in home equity entering the second quarter–with $11.5 trillion considered “tappable”–according to ICE Mortgage Technology, Atlanta.

ICE Mortgage Monitor: Property Insurance Rates Affecting Trends

Intercontinental Exchange Inc., Atlanta, released its March Mortgage Monitor, highlighting the effects of increasing insurance costs on housing trends.

ICE: 2024 Saw Softest Home Price Growth in Years; Mortgage Delinquencies Trending Higher

Home prices ended the year on an up note, but 2024 was the softest year for home price growth in more than a decade, according to Intercontinental Exchange.

ICE Mortgage Monitor: Monthly Payments Hit High Point in August

Intercontinental Exchange, Atlanta, released its mortgage monitor for October, finding that the average monthly payment hit a record of $2,070 in August, up $140 from 2023 and $399 since the start of 2020.

ICE Mortgage Monitor: Tappable Equity Hits Record $11.5 Trillion

Mortgage holders’ equity levels continue to reach new heights, according to Intercontinental Exchange, Inc.

ICE Mortgage Monitor: Share of Mortgages Above 5% Interest Rate Creeps Up

Intercontinental Exchange, Atlanta, released its latest mortgage monitor with May’s data. Among other findings, 24% of mortgage holders had interest rates of 5% or higher, up from just 10% in 2022.

ICE Mortgage Technology’s Vicki Vidal and Haris Jusic: What You Need to Know About the FHA’s Payment Supplement

During the COVID-19 pandemic, when rates remained low, the FHA streamlined its home retention loss mitigation options and provided relief for nearly 1.9 million borrowers. Despite these efforts, the current climate of high mortgage interest rates poses challenges for initiating loan modifications.