ICE Mortgage Monitor Finds Some Early Signs of Stress for Homeowners

(Image courtesy of Vlada Karpovich/pexels.com)

ICE Mortgage Technology, Atlanta, released its July 2025 Mortgage Monitor report, finding that there are early signs of financial stress emerging among subsets of homeowners.

For one, annual home price growth has slowed–or in some cases, dipped–potentially weakening the equity positions of borrowers who purchased more recently. Nationwide, one in four seriously delinquent loans would be in a negative equity position if sold at distressed/REO prices.

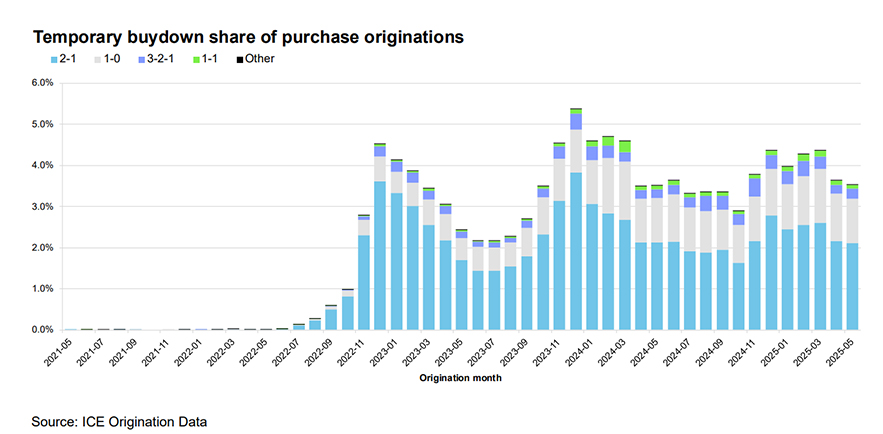

More than 8% of borrowers have financed homes with ARMs or temporary buydowns this year, which could lead to payment shock down the road depending on future interest rates.

There was additional financial strain from the return of payments and collection efforts on defaulted federal student loans after a five-year pause.

“While the slowdown in home price growth may be easing affordability pressures, and negative equity volumes remain low, we’re beginning to see localized pockets of recent homebuyers becoming financially exposed,” said Andy Walden, Head of Mortgage and Housing Market Research at ICE. “Borrowers with minimal equity–particularly those who purchased recently–are often the first to be exposed when home prices soften. These early signs of stress highlight the importance of monitoring borrower-level risk as market conditions evolve.”

And, despite prices decelerating somewhat, buyers still continue to face challenges. The average debt-to-income ratio, including mortgage debt, hit 40% in May–only slightly down from the all-time high of 40.5% in late 2023.