ICE Mortgage Monitor: Property Insurance Costs Continue to Grow

(Image courtesy of Efrem Efre/pexels.com)

ICE Mortgage Technology, Atlanta, released its ICE Mortgage Monitor Report, highlighting a continued surge in property insurance costs.

It found that the average annual property insurance payment for a single-family mortgage holder has hit nearly $2,370 per year, up 11.3% annually.

Property insurance costs are accounting for a record 9.6% of average monthly mortgage-related expenses when factoring in principal, interest, taxes and insurance.

Cost per $1,000 of coverage rose by 5% (29 cents) over the past 12 months and by 16% (85 cents) since 2022.

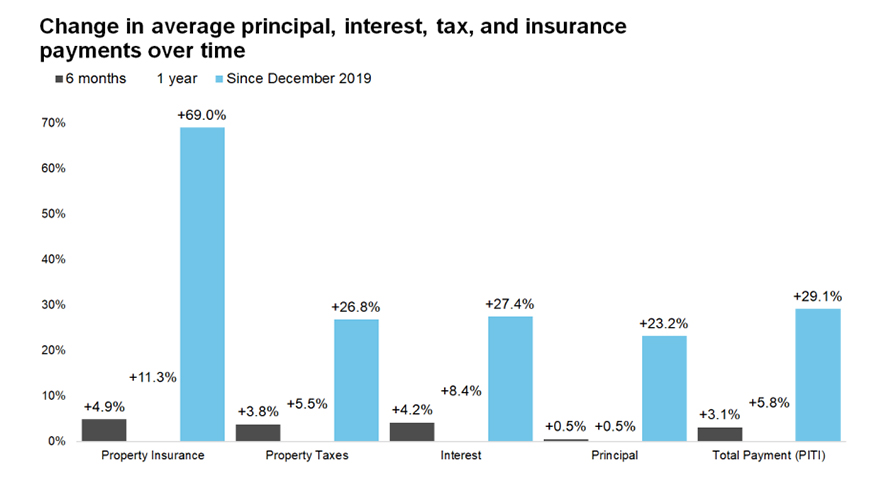

“Property insurance costs continue to be the fastest growing subcomponent of mortgage payments among existing homeowners,” said Andy Walden, head of mortgage and housing market research at ICE. “While mortgage principal, interest and property tax payments have all increased in recent years, insurance has far outpaced those gains, rising 4.9% in 2025, 11.3% annually and nearly 70% over the past five and a half years. That rapid escalation now means insurance alone consumes almost one in every 10 dollars spent on average mortgage-related costs.”

Other notable findings from the report include that HELOC withdrawal costs are falling significantly, down 25% over the last year and a half. That drove $52 billion in cash-out refis and second liens, the highest level in nearly 3 years, during Q2.

Looking to affordability, August also marked the first increase in annual home price growth–by 1.2%–after 7 consecutive months of cooling numbers.

It currently requires 31.1% of the median household income to make the mortgage payment of the average priced home, well above the long-run average of 24-25%.