The Federal Housing Finance Agency last week announced 2021 multifamily loan purchase caps for Fannie Mae and Freddie Mac at $70 billion for each Enterprise, totaling $140 billion in support to the multifamily market.

Tag: Freddie Mac

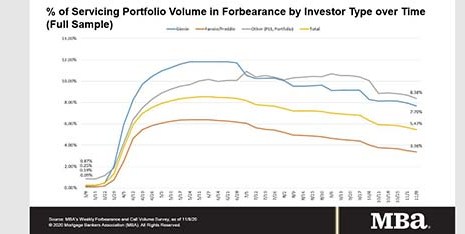

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

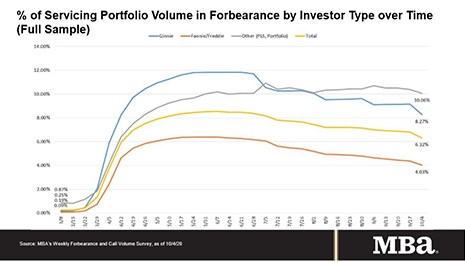

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

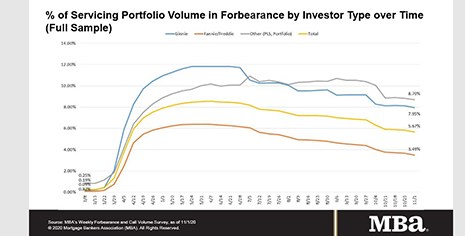

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

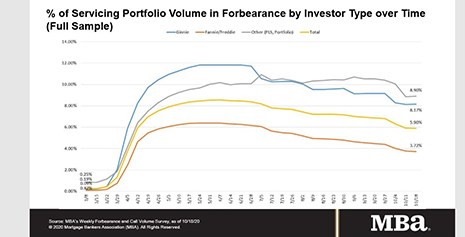

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

GSE Executives Discuss Pandemic Response, Defend New Refinance Fee

The government-sponsored enterprises have supported and provided critical liquidity to the market throughout the COVID-19 pandemic, Fannie Mae and Freddie Mac executives said.

MBA Annual20: FHFA Proposes Rule for New Enterprise Products, Activities

Federal Housing Finance Agency Mark Calabria yesterday told MBA members that the agency wants comments on a proposed rule that would require Fannie Mae and Freddie Mac to obtain approval for new products and notice before engaging in new activity.

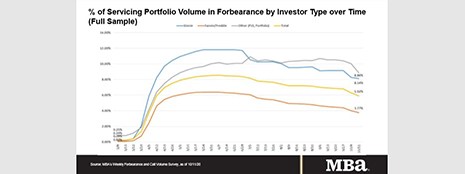

MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3 million homeowners are in forbearance plans.

MBA Urges FHFA to Extend Current GSE Affordable Housing Goals

The Mortgage Bankers Association, in a letter this morning to the Federal Housing Finance Agency, said FHFA should extend current affordable housing goals for Fannie Mae and Freddie Mac, given current economic uncertainty.

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

MBA Offers FHFA Recommendations on GSE Strategic Plan

The Mortgage Bankers Association, in comments yesterday to the Federal Housing Finance Agency, said the FHFA Strategic Plan for fiscal years 2021-2024 should continue to work toward an ultimate goal: releasing Fannie Mae and Freddie Mac from federal conservatorship—but only when they are able to do so without risk to the real estate finance markets.