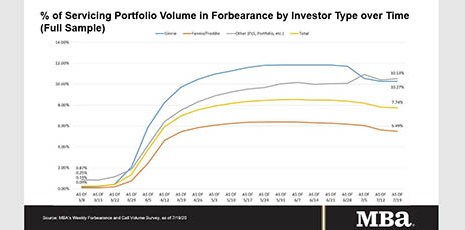

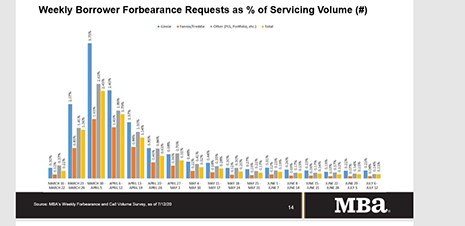

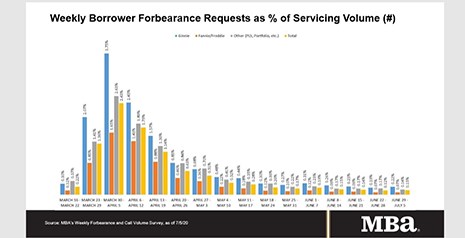

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Tag: Coronavirus

S&P: Retail REITs Could Face Distress Until At Least 2021

S&P Global Ratings, New York, said retail real estate investment trusts, already buffeted by the coronavirus pandemic and dwindling brick-and-mortar revenues, could see an increase in downgrades in coming quarters with little chance of recovery before next year.

Keeping Current With Midland Loan Services’ Tim Steward

MBA NewsLink interviewed Timothy E. Steward, Senior Vice President and co-head of Midland Loan Services, a PNC Real Estate business. Steward leads a team of more than 500 professionals responsible for delivering loan servicing, asset management and technology solutions to the commercial real estate finance industry.

Maurice Jourdain-Earl of ComplianceTech on CARES Act Relief and Racial Disparities in Mortgage Forbearance

MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.

FHFA Leaves 2021 GSE Housing Goals Unchanged

With current housing goals set to expire in December, and amid economic uncertainty stemming from the lingering coronavirus pandemic, the Federal Housing Finance Agency yesterday left 2021 housing goals for Fannie Mae and Freddie Mac unchanged from the previous three years.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

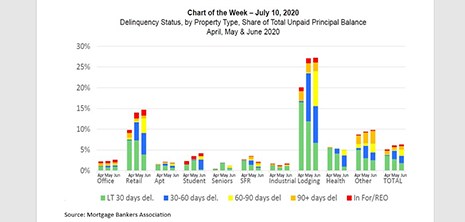

MBA Chart of the Week: Delinquency Status of Unpaid Principal Balance 2nd Quarter

The $3.7 trillion commercial and multifamily mortgage market is really a confederation of different capital sources, property types and geographic markets, all bound together by the provision of mortgage capital backed by investment property incomes and collateral value. Often, the overall market moves in tandem. At other times – like now – different segments act very differently.

FHFA Extends GSE Loan Processing Flexibilities Through Aug. 31

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will extend several loan origination flexibilities until August 31 to ensure continued support for borrowers during the COVID-19 national emergency.

Faith Schwartz: New Era Borne of Pandemic to Upend Mortgage Costs

As longtime industry participants, we at Housing Finance Strategies contend that the pandemic has created a revolutionary opportunity that we must seize and leverage so that the mortgage business can emerge with higher quality prospective products funded through a drastically reduced cost structure.