MBA: Share of Loans in Forbearance Falls for 6th Straight Week

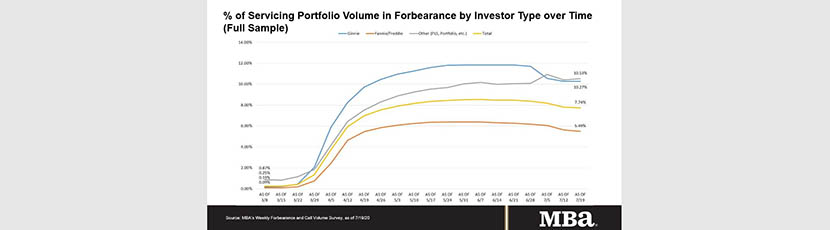

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the seventh week in a row to 5.49% – a 15-basis-point improvement. Ginnie Mae loans in forbearance increased by 1 basis point to 10.27%, and the forbearance share for portfolio loans and private-label securities increased by 12 basis points to 10.53%. The percentage of loans in forbearance for depository servicers dropped to 8.06%, while the percentage of loans in forbearance for independent mortgage bank servicers rose to 7.85%.

“The share of loans in forbearance declined by a smaller amount than in previous weeks, as the pace of borrowers exiting forbearance slowed,” said MBA Chief Economist Mike Fratantoni. “Although the GSE portfolio of loans in forbearance should continue to improve, Ginnie Mae’s portfolio saw an uptick of both loans in forbearance and borrowers requesting forbearance. The high level of unemployment claims in recent weeks may be playing a role, as weakness would likely impact Ginnie Mae’s portfolio first.”

Fratantoni noted as a result of large buyouts from Ginnie Mae pools in recent weeks, many FHA and VA loans are now being held as portfolio loans by bank servicers. “That is why the share of portfolio loans in forbearance has increased and is now typically at a higher level than that for Ginnie Mae loans,” he said.

Key findings of the MBA Forbearance and Call Volume Survey – July 13 -19:

- Total loans in forbearance decreased by 6 basis points relative to the prior week: from 7.80% to 7.74%.

- By investor type, the share of Ginnie Mae loans in forbearance increased: from 10.26% to 10.27%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 5.64% to 5.49%.

- The share of other loans (e.g., portfolio, and PLS loans) in forbearance increased relative to the prior week: from 10.41% to 10.53%.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat relative to the prior week at 0.13%.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls increased for the third week from 8.3% to 9.0%.

- Average speed to answer remained flat relative to the prior week at 2.6 minutes.

- Abandonment rates decreased from 7.2% to 6.8%.

- Average call length decreased from 7.6 minutes to 7.2 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of July 19:

- Total: 7.74% (previous week: 7.80%)

- IMBs: 7.85% (previous week: 7.83%)

- Depositories: 8.06% (previous week: 8.23%)

MBA’s latest Forbearance and Call Volume Survey represents 75% of the first-mortgage servicing market (37.3 million loans).