CoreLogic, Irvine, Calif., released its Homeowner Equity Report for the fourth quarter of 2024, finding that nationwide, borrower equity increased by $281.9 billion. That’s an increase of 1.7% year-over-year.

Tag: CoreLogic

CoreLogic: U.S. Overall Delinquency Rate at 3.1% in December

CoreLogic, Irvine, Calif., reported that the U.S. overall delinquency rate was flat year-over-year, but dropped slightly from November.

CoreLogic: Investor Share Likely to Remain Roughly Quarter of Total Sales

CoreLogic, Irvine, Calif., released its report on Q3 2024 investor activity on home purchases, finding a small uptick from mid-year numbers.

CoreLogic: National Homeowner Equity Up 2.5% in Q3

CoreLogic, Irvine, Calif., found that U.S. homeowners with mortgages saw equity increase by $425 billion since Q3 2023—a gain of 2.5% year-over-year.

CoreLogic: Delinquency Rate Rises Slightly in September

CoreLogic, Irvine, Calif., reported that for September, 3% of all mortgages were in some stage of delinquency.

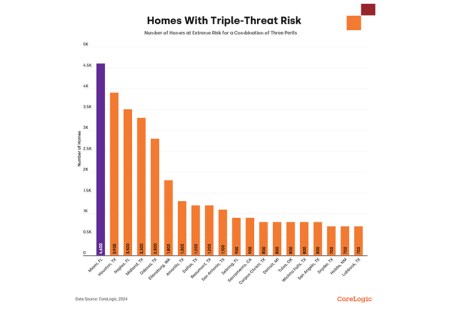

CoreLogic: 33,000 Homes Face ‘Triple-Threat’ From Natural Disasters

CoreLogic, Irvine, Calif., reported that across the U.S., 33,000 homes face a triple threat–essentially, year-round extreme risk from three natural disasters.

CoreLogic: Mortgage Application Fraud Risk Index Up 8.3% in Q2

CoreLogic, Irvine, Calif., released its latest fraud report, finding that its Mortgage Application Fraud Risk Index increased 8.3% year-over-year in the second quarter and 1.1% from the first quarter.

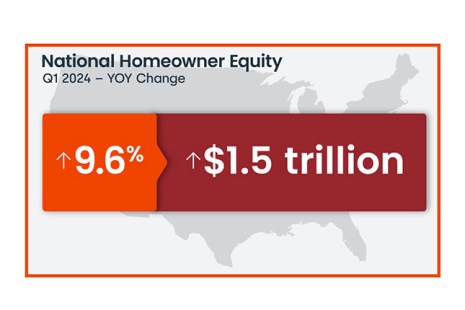

CoreLogic: Homeowner Equity Increases to Near All-Time High in Q1

CoreLogic, Irvine, Calif., released its Homeowner Equity Insights Report for the first quarter, finding that U.S. homeowners with mortgages saw home equity increase by 9.6% year-over-year.

CoreLogic: Delinquency, Foreclosure Rates Low in February

CoreLogic, Irvine, Calif., reported the overall mortgage delinquency rate was at 2.8% in February, down from 3% in February 2023.

CoreLogic: January Mortgage Delinquency Rate Near Record Low

CoreLogic, Irvine, Calif., said the U.S. housing market posted an overall delinquency rate of 2.8% in January, approaching a record low.