CoreLogic: Delinquency Rate Rises Slightly in September

(Image courtesy of Caner B/pexels.com)

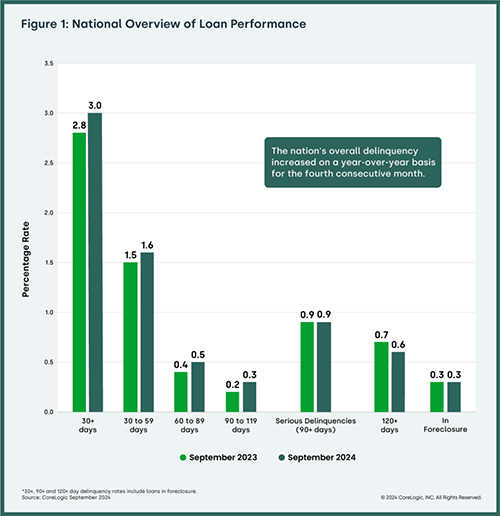

CoreLogic, Irvine, Calif., reported that for September, 3% of all mortgages were in some stage of delinquency.

That compares with 2.8% in September 2023 and marks the fourth consecutive month the nation’s overall delinquency rate rose.

In terms of different stages of delinquencies, early stage delinquencies (defined as 30-59 days past due) were at 1.6%, up from 1.5% in September 2023.

Adverse delinquencies (defined as 60 to 89 days past due) were 0.5%, up from 0.4% in September 2023.

Serious delinquencies (defined as 90 days or more past due, including loans in foreclosure) were at 0.9%, flat from September 2023.

The transition rate (defined as the share of mortgages that transitioned from current to 30 days past due) was also flat at 0.8%.

The foreclosure inventory rate–which CoreLogic defines as the share of mortgages in some stage of the foreclosure process–was 0.3%, flat year-over-year. The foreclosure inventory rate remains near record lows going back to 1999.

“Loan performance in the third quarter of 2024 showed a continual upward trend in mortgage delinquencies. Delinquencies remain low, particularly when compared with those during the Great Recession. However, 70% of metropolitan areas showed an increase in the overall delinquency rate from a year earlier, and more concerning, 30% of metropolitan areas showed an increase in the serious delinquency rate,” Molly Boesel, Senior Principal Economist for CoreLogic.

“As recently as the second quarter of 2024, only 5% of metros recorded an increase in serious delinquency rates. The increase in the serious delinquency rate shows that borrowers who enter the delinquency pipeline are having difficulty catching up on their late payments,” she continued.