MBA: IMBs Report Net Production Losses in the First Quarter of 2024

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $645 on each loan they originated in the first quarter of 2024, a decrease from the reported loss of $2,109 per loan in the fourth quarter of 2023, according to the Mortgage Bankers Association’s (MBA) newly released Quarterly Mortgage Bankers Performance Report.

MBA Asks FHFA to Address Outstanding Questions Before Approving Freddie Mac Second Mortgage Proposal

The Mortgage Bankers Association posed several questions to the Federal Housing Finance Agency about Freddie Mac’s proposed purchase of single-family closed-end second mortgages.

Origination Issues in Commercial Servicing: Communication Is Vital, Panel Says

NEW ORLEANS–Making sure originators and servicers are on the same page–on a variety of topics–is helpful to avoid issues down the road, panelists said during a discussion at the Mortgage Bankers Association Commercial/Multifamily Finance Servicing and Technology Conference May 21.

TransUnion Finds Consumer Credit Appetite Remains High

The consumer credit market remains resilient in the face of a challenging economic environment, according to TransUnion, Chicago.

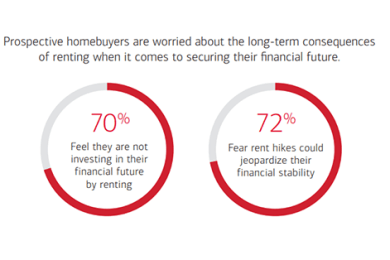

BofA: 70% of Prospective Homebuyers Feel Renting Could Harm Their Financial Future

Many prospective homebuyers fear the long-term consequences of renting, including 70% who feel they’re not making a long-term investment in their future, and 72% who worry that rent increases could affect their finances, according to a new Bank of America report.

23 Mortgage Servicers Earn CCMS Designation at MBA CMST Conference

NEW ORLEANS–Twenty-three mortgage servicers earned their Certified Commercial Mortgage Servicer designations here at the Mortgage Bankers Association’s Commercial/Multifamily Finance Servicing and Technology Conference.