CoreLogic: Delinquency Rate Rises Slightly in September

CoreLogic, Irvine, Calif., reported that for September, 3% of all mortgages were in some stage of delinquency.

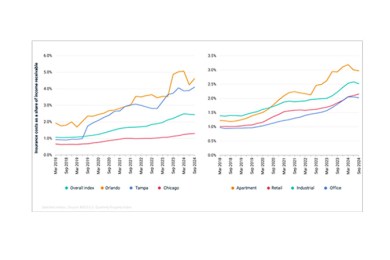

MBA: Commercial Mortgage Delinquency Rates Increase in Third Quarter

Commercial mortgage delinquencies increased in the third quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

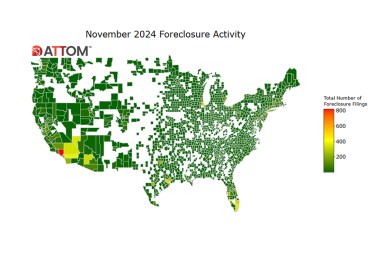

ATTOM: Foreclosure Filings Fall in November

ATTOM, Irvine, Calif., released its November 2024 U.S. Foreclosure Market Report, finding that foreclosure filings are down 9% from a year ago and down 5% from October.

Chart of the Week: Unemployment by Duration

Based on the November 2024 jobs report, the unemployment rate is above 4.2%, the household survey again showed a large drop in employment, and more households reported spells of long-term unemployment, which is typically defined as being unemployed for 27 weeks or more.

TransUnion Predicts Mortgage Delinquencies Will Be Flat

TransUnion, Chicago, released its forecast for 2025, predicting that mortgage delinquencies will be flat a year from now in Q4 2025.

CoreLogic: National Homeowner Equity Up 2.5% in Q3

CoreLogic, Irvine, Calif., found that U.S. homeowners with mortgages saw equity increase by $425 billion since Q3 2023—a gain of 2.5% year-over-year.