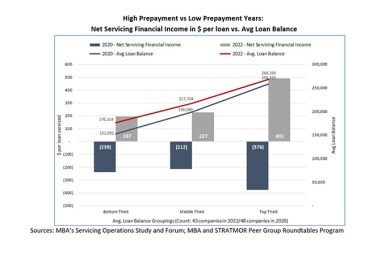

MBA White Paper Measures the Impact of Loan Sizes on Profitability Through Mortgage Cycles

The conventional wisdom is that originating and servicing higher balance loans means higher profits. However, according to a new white paper by the Mortgage Bankers Association titled, How do Mortgage Revenues, Costs and Profitability Vary by Loan Balance? An Analysis Using Benchmarking Data, the relationship between loan balance and profitability is more nuanced and may change over the course of market cycles.

MBA Weighs in With Senate on Property Insurance Market

The Mortgage Bankers Association weighed in with the Senate Committee on Banking, Housing and Urban Affairs last week regarding challenges in the property insurance market and their impact on consumers.

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increased in Second Quarter

Commercial and multifamily mortgage delinquencies increased in the second quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

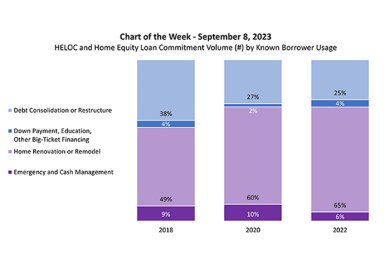

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

Dollar volume of open-end home equity lines of credit (HELOCs) and closed-end home equity loans originated in 2022 increased 50 percent compared to 2020, driven by home renovation or remodeling, according to MBA’s latest Home Equity Lending Study. This week’s Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan, according to participants in our study.

CoreLogic Homeowner Equity Report Shows Positive Gains From Q1 to Q2

CoreLogic, Irvine, Calif., released its Homeowner Equity Report for the second quarter. While U.S. homeowners with mortgages saw home equity decrease 1.7% year-over-year, they also saw gains from the previous quarter–an average of $13,900.