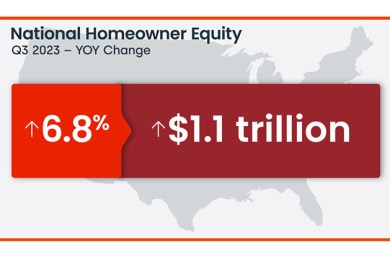

CoreLogic: Homeowner Equity Up 6.8%

CoreLogic, Irvine, Calif., found U.S. homeowners with mortgages’ equity has increased by $1.1 trillion since this time last year, a 6.8% gain year-over-year.

ATTOM: California, New Jersey, Illinois Have Highest Concentrations of At-Risk Markets

California, New Jersey and Illinois have the highest concentrations of the most-at-risk markets in the country, according to ATTOM, Irvine, Calif.

CMBS Special Servicing Rate Ticks Upward in November: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

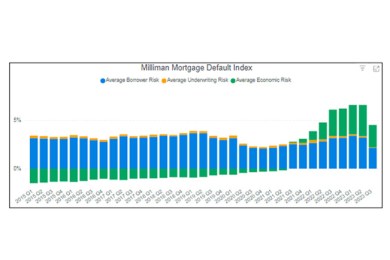

Milliman: Mortgage Default Risk at 3.1% for Loans Acquired in Q3 2023

Milliman, Seattle, released its third-quarter Milliman Mortgage Default Index, which showed that quarter-over-quarter, mortgage default risk increased to 3.1% for loans acquired during the quarter from an adjusted 3.03% in the second quarter.

Craftsman: Homeowners Eye Home Improvement Projects Over Selling

Craftsman, part of Stanley Black & Decker, Towson, Md., released a survey finding that two in three American homeowners intend to make home improvements in the next six to 12 months.