CMBS Special Servicing Rate Ticks Upward in November: Trepp

(Illustration courtesy of Trepp LLC)

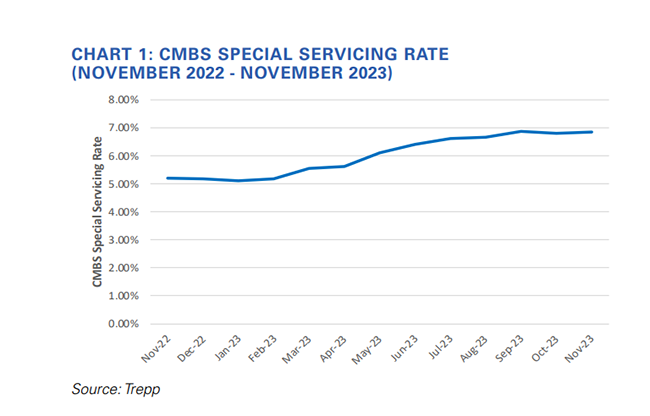

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

“After its first decrease of the year in October, the rate followed up with a modest uptick last month,” Trepp said in its November CMBS Special Servicing Report. Prior to this, the rate was quite steady for most of the year before falling 140 basis points in October.

The office rate rose 32 basis points to 8.87%, Trepp said, noting the only property type to see a decrease was mixed-use, which fell by 104 basis points to 6.66%.

There were $2.24 billion worth of new special servicing transfers in November. “As is typical, office dominated this balance, its $1.28 billion accounting for 57% of the month’s total,” the report said. “Lodging properties were next-most, their $419 million balance representing about 19% of the month’s newly transferred balance.”

Overall, the U.S. CMBS special servicing rate is up from 5.22% one year ago. Six months ago, the CMBS special servicing rate equaled 6.11%.

Looking at CMBS 2.0+ figures, Trepp said the overall CMBS 2.0+ special servicing rate equals 6.67%, up from 4.95% one year ago. Six months ago, the CMBS 2.0+ special servicing rate was 5.89%.