MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

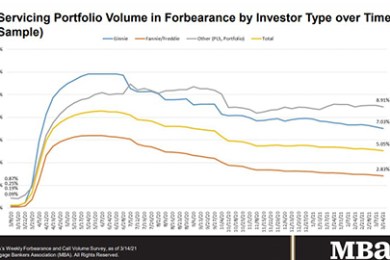

MBA: Share of Loans in Forbearance Falls to 5.05%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance fell by 9 percent to 5.05% of mortgage servicers’ portfolio volume as of March 14 from 5.14% the week earlier–the lowest level in nearly a year. MBA estimates 2.5 million homeowners are in forbearance plans.

MBA RIHA Study: Affordability Growing Challenge for Low-, Moderate-Income Renters in Majority of Top 50 Metro Areas

Home prices and rent appreciation have exceeded income growth since the turn of the 21st century. This has created economic obstacles for many American households, especially for low- and moderate-income renters living in cities with recent employment growth but significant housing supply constraints.

MBA: Commercial/Multifamily Mortgage Debt Up 5.8 Percent in Fourth Quarter

Commercial/multifamily mortgage debt outstanding at the end of 2020 rose by $212 billion (5.8 percent) from the previous year, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report said.