Share of Mortgage Loans in Forbearance Decreases to 3.76%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 3.76% of servicers’ portfolio volume as of July 4 from 3.87% the week before,–the 19th consecutive weekly decline. MBA estimates 1.9 million homeowners are in forbearance plans.

MBA Asks FHFA for Clarity on GSE Short-Term Rental Policies

The Mortgage Bankers Association, in a July 6 letter to the Federal Housing Finance Agency, asked FHFA for more definitive guidance on the government-sponsored enterprises’ policies on mortgages for properties that include short-term rental units.

MBA Letter Urges Support of HUD Priorities in Fiscal 2022 Appropriations Bill

Ahead of a scheduled vote this week, the Mortgage Bankers Association asked the House Appropriations Committee to support key fiscal year 2022 appropriations proposed to HUD, FHA and Ginnie Mae.

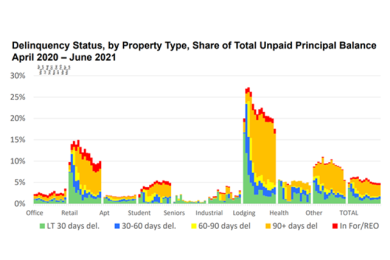

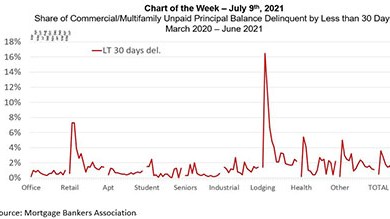

MBA Chart of the Week, July 13, 2021: Commercial/Multifamily Delinquencies

When looking at commercial and multifamily mortgage delinquency rates, we tend to exclude loans that have been delinquent for less than 30 days, as many may be experiencing a temporary “hiccup” that will be quickly remedied before the next payment is due. But examining these rates can provide key insights into commercial and multifamily mortgage performance through the pandemic and into today.