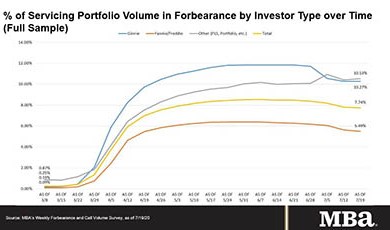

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Black Knight: Mortgage Delinquencies Improve for the First Time Since January; Serious Delinquencies Surge to 9-Year High

Black Knight, Jacksonville, Fla., said after rising from 3.2% in January to 7.8% in May, the national delinquency rate improved for the first time in five months, falling to 7.6% in June as the overall number of past-due mortgages declined by 98,000.

Second-Quarter Home Seller Profits Rise to 36%

ATTOM Data Solutions, Irvine, Calif., said its second-quarter 2020 U.S. Home Sales Report showed home sellers nationwide realized a gain of $75,971 on the typical sale, up from the $66,500 in the first quarter and from $65,250 a year ago.

HUD Terminates Affirmatively Furthering Fair Housing Rule

The Trump Administration terminated the Obama-era Affirmatively Furthering Fair Housing rule, replacing it with a new rule that HUD Secretary Ben Carson said would ease burdens for local communities dealing with fair housing.

Fitch: Borrowers Skipping Payments on Home Loans More Often Than Other Debt

Residential mortgage borrowers are missing more payments and taking advantage of payment holiday programs at a higher rate than comparable-credit borrowers of auto loans and credit cards, said Fitch Ratings New York.