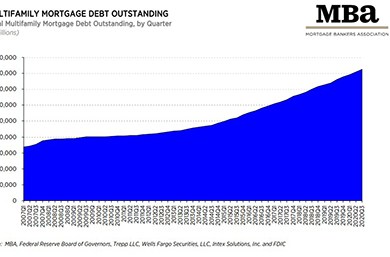

MBA: 3Q Commercial/Multifamily Mortgage Debt Up 1.5%

Commercial/multifamily mortgage debt outstanding rose by $57.0 billion (1.5 percent) in the third quarter, the Mortgage Bankers Association reported this morning.

MBA, Trade Groups Urge Treasury to Promote ‘Critical Reforms’ of GSEs

More than 12 years after the federal government placed Fannie Mae and Freddie Mac under conservatorship—and seemingly no closer to moving them out of conservatorship—the Mortgage Bankers Association and several industry trade groups urged the Treasury Department to promote “critical reforms” of the GSEs and bolster their safety and soundness.

CFPB Issues Final Mortgage Rules on General QM, Seasoned QM

The Consumer Financial Protection Bureau on Thursday issued final rules related to qualified mortgage loans. The Mortgage Bankers Association provided preliminary summaries of the final rules.

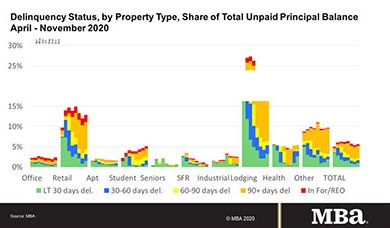

MBA: Commercial/Multifamily Mortgage Delinquency Rates Continue to Vary by Property Types, Capital Sources

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released Thursday by the Mortgage Bankers Association.

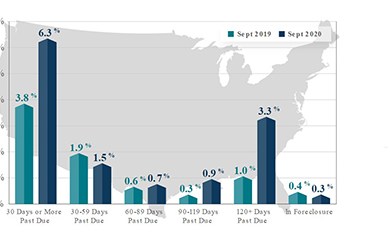

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

ATTOM: Fewer Foreclosure Filings as Moratoria Extend into 2021

ATTOM Data Solutions, Irvine, Calif., said foreclosure filings continued to fall last month amid the budding holiday season and federal and state foreclosure moratoria.

The Redesigned URLA Is Coming Jan. 1. Are You Ready?

<!-- wp:paragraph -->

<p><a><span class="has-inline-color has-black-color">Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4.</span></a> Beginning January 1, 2021, all lenders, aggregators and third-party originators who are ready to send and accept the redesigned URLA may participate in the two-month Open Production Period (OPP), which allows for a gradual transition prior to the March 1, 2021 mandate.</p>

<!-- /wp:paragraph -->