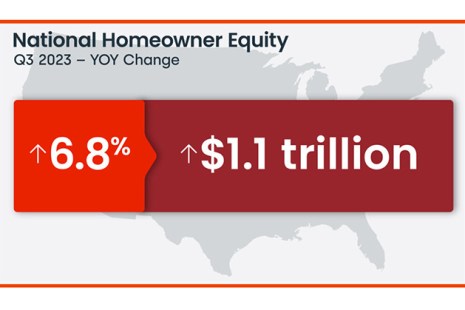

CoreLogic, Irvine, Calif., found U.S. homeowners with mortgages’ equity has increased by $1.1 trillion since this time last year, a 6.8% gain year-over-year.

Category: News and Trends

ATTOM: California, New Jersey, Illinois Have Highest Concentrations of At-Risk Markets

California, New Jersey and Illinois have the highest concentrations of the most-at-risk markets in the country, according to ATTOM, Irvine, Calif.

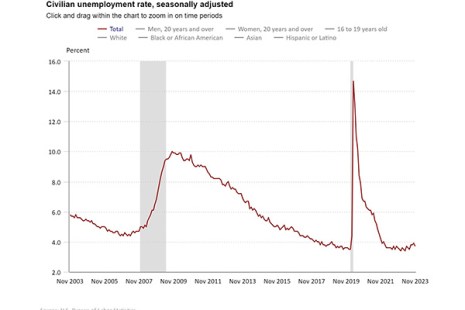

Jobs Increase in November, Unemployment Rate at 3.7%

Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate now sits at 3.7%, the U.S. Bureau of Labor Statistics reported.

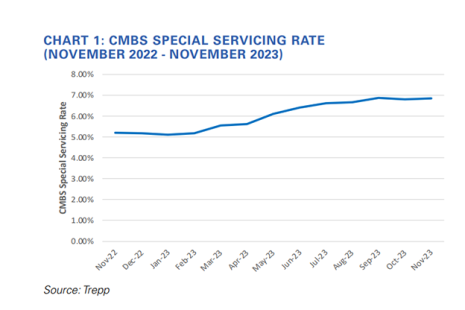

CMBS Special Servicing Rate Ticks Upward in November: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

Servicing Quote Tuesday, Dec. 12, 2023

“With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year. And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up.”

–Selma Hepp, Chief Economist for CoreLogic

MBA: Commercial Mortgage Delinquency Rates Increased in Third Quarter

Commercial mortgage delinquencies increased in the third quarter, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

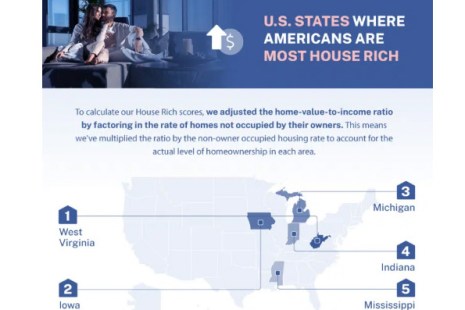

All Star Home: West Virginia Most “House Rich” State

All Star Home, Raleigh, N.C., sought to figure out what state is the most “house rich,” a status it defined as homeownership being dominant and homes being relatively affordable compared to the local median income. Per its analysis, West Virginia took the top spot.

Fitch: 2024 Outlook for Mortgage Insurers Revised to Neutral

Fitch Ratings, New York, has revised its 2024 sector outlook for U.S. mortgage insurers to neutral. Previously the outlook had it at deteriorating.

MBA Newslink Q&A: Toby Wells, President of Cornerstone Servicing

MBA NewsLink interviewed Cornerstone Servicing President Toby Wells about technology advances that improve default servicing operations and borrower communications.

FHFA Announces Increase to Conforming Loan Limit Values for 2024

The Federal Housing Finance Agency raised the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $766,550 in 2024, an increase of $40,350 from 2023.