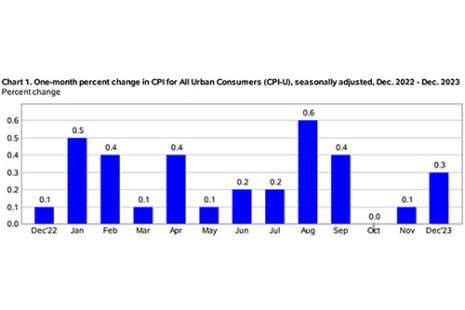

The headline inflation rate increased modestly during December, the Bureau of Labor Statistics reported Thursday.

Category: News and Trends

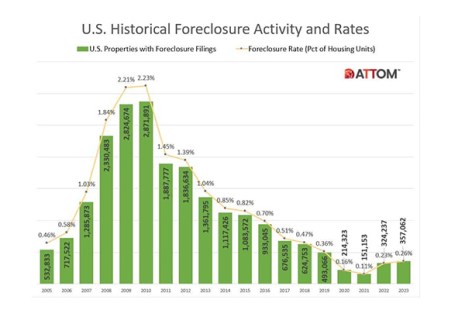

ATTOM: 2023 Foreclosure Filings Top 2022, but Remain Below Pre-Pandemic Numbers

ATTOM, Irvine, Calif., released data on year-end 2023 foreclosures, finding that foreclosure filings were up 10% from 2022 and 136% from 2021. However, they were down 28% from pre-pandemic 2019.

Servicing Quote Tuesday, Jan. 16, 2024

“Reflecting on 2023, we see the recent rise in foreclosure activity as a market correction rather than a cause for alarm. It signals a return to more traditional patterns after years of volatility.”

–Rob Barber, CEO at ATTOM.

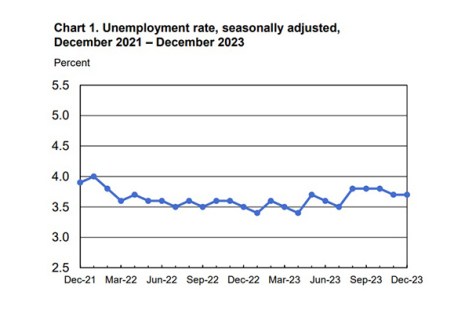

Job Market Grows by 216,000 in December

The job market held steady in December, with growth in payrolls of 216,000 and the unemployment rate unchanged at 3.7%, the U.S. Bureau of Labor Statistics reported Friday.

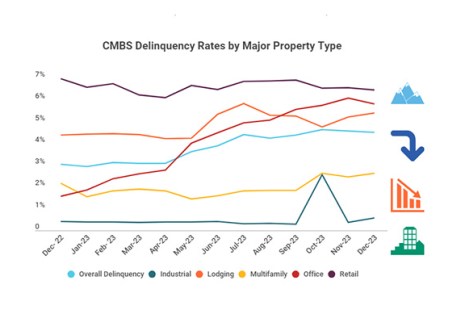

Trepp: CMBS Delinquency Rate Falls in December

Trepp, New York, noted the overall commercial mortgage-backed securities delinquency rate fell by seven basis points to 4.51% in December.

MBA NewsLink Q&A with Clarifire’s Jane Mason: Navigating Loss Mitigation Challenges

MBA NewsLink interviewed Clarifire CEO and Founder Jane Mason about mortgage servicing challenges in the current landscape.

CoreLogic: October Delinquency Rate Flat

CoreLogic, Irvine, Calif., reported 2.8% of mortgages were delinquent by 30 or more days in October; the same rate was recorded in both September 2023 and October 2022.

MBA NewsLink Roundtable: Top Commercial Mortgage Servicing Issues to Watch in 2024

With the logjam in the commercial real estate transaction market top of mind for many, loan servicing and asset management professionals entered the new year with a fresh set of opportunities and challenges defined not by a flood of new originations but the expectation of a growing supply of troubled loans.

To the Point With Bob: Thoughts Ahead of #MBAIMB24–Consumers Benefit From Large, Diverse Collection of Mortgage Lenders

MBA President and CEO Bob Broeksmit, CMB, shares his thoughts on topics related to IMBs ahead of #MBAIMB24.

Servicing Quote Tuesday, Jan. 9, 2024

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low.”

–Molly Boesel, Principal Economist for CoreLogic