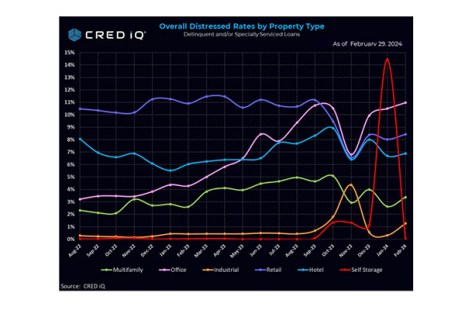

CRED iQ, Wayne, Pa., reported the Distress Rate for all property types trimmed 4 basis points in February to 7.35%. However, the multifamily distress rate was up 80 basis points–the largest monthly increase in that sector in more than a year and a half.

Category: News and Trends

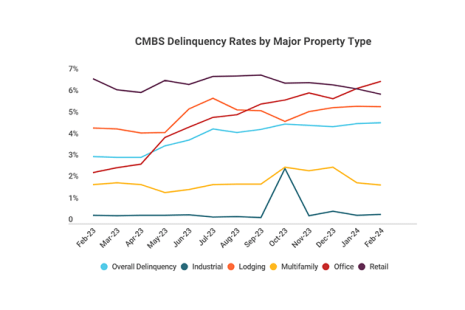

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.

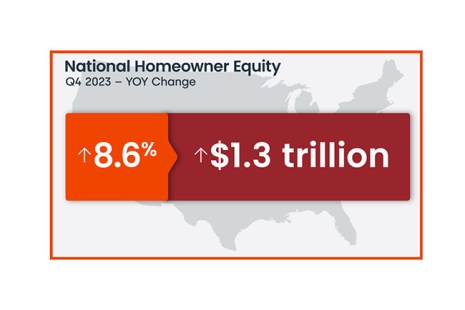

CoreLogic: Homeowner Equity Up 8.6% in Q4 2023

CoreLogic, Irvine, Calif., released its Homeowner Equity Insights report for the fourth quarter of 2023, finding homeowners with mortgages have seen their equity increase by a total of $1.3 trillion since Q4 2022. That’s a gain of 8.6% year-over-year.

Asurity’s Diane Jenkins: Hello Old Friend – Why Assumptions Are Making a Comeback

It’s no secret that mortgage lenders have seen a sharp decrease in origination volumes over the past two years. Higher interest rates coupled with a shortage in housing inventory translate into a market environment where origination volumes are likely to remain depressed for the near future.

MBA Statement on the Biden Administration’s Housing Affordability Initiatives Warns Against CFPB Reforms on Closing Costs, Title Insurance

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Biden administration’s announcements on housing at the State of the Union address.

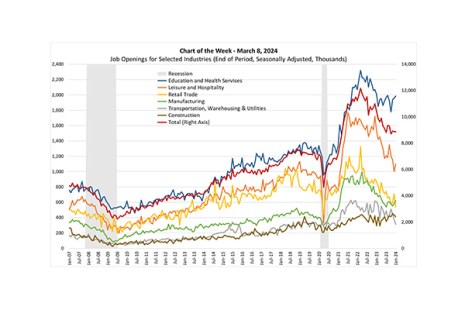

MBA Chart of the Week: Job Openings for Selected Industries

Last week Fed Chair Jay Powell testified to Congress that as “labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals have been moving into better balance.”

MBA Warns CFPB Against Unnecessary Reforms to Mortgage Rules

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Consumer Financial Protection Bureau’s (CFPB) blog post Friday morning on housing costs.

Servicing Quote Tuesday, March 5, 2024

“MBA has led the industry over the past two years in a constructive engagement with the Federal Housing Finance Agency and the GSEs to develop more effective alternatives to a repurchase request when dealing with loan defects on performing loans.”

–MBA President and CEO Bob Broeksmit, CMB

MBA Education Path to Diversity Scholar Profile: Sol Duree

(One in a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

ICE Mortgage Monitor: 2023 Saw Three-Decade Low in Originations

Intercontinental Exchange Inc., Atlanta, released its Mortgage Monitor report for March, featuring some full-year 2023 insights. Among those, the report recorded only 4.3 million mortgages as originated in 2023, the lowest since ICE began tracking the data 30 years ago.