MBA Chart of the Week: Job Openings for Selected Industries

(Image courtesy of MBA; Source: U.S. Bureau of Labor Statistics, Job Openings and Labor Turnover Survey (JOLTS))

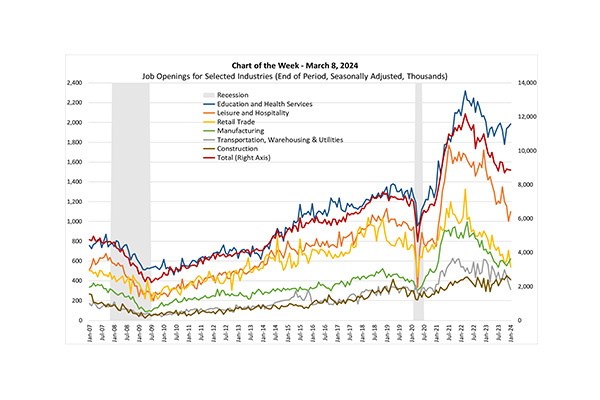

Last week Fed Chair Jay Powell testified to Congress that as “labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals have been moving into better balance.” On Wednesday, the Job Openings and Labor Turnover Survey (JOLTS) data from the U.S. Bureau of Labor Statistics showed that there were 8.9 million job openings at the end of January 2024, down 27% from the series high of 12.2 million in March 2022, but still significantly higher than historical averages. Despite the labor market remaining constrained with 1.45 openings per unemployed worker, the labor market is slowly settling down.

In this week’s Chart of the Week, we examine the JOLTS monthly series on job openings for selected industries. For example, there were around one million openings in leisure and hospitality in 2019 (orange line). This fell to 335,000 in April 2020, peaked at almost 1.8 million in July 2021, and was down to 1.1 million, close to pre-pandemic levels, at the end of January. Similarly, the rapid growth in openings for education and health services (blue line) from about 1.3 million in the year before the pandemic to over 2.3 million in March 2022 has fallen to fewer than 2 million at the end of January. Comparing the series for these industries suggests that education and health services still feel labor shortages with openings above pre-pandemic trends.

Construction openings (brown line) have followed an upward trend since the end of the Great Recession (during which the series fell to a low of 24,000). Construction openings were moderately disturbed during the pandemic and have moved between approximately 350,000 to 450,000 in recent months. While builders have reported labor shortages, they also face growing supply-side challenges in the form of higher prices and/or shortages of lumber and lots, which likely also limits how much labor they can hire at any given time.

The strong labor demand has fueled an increase in average hourly earnings for all employees on private nonfarm payrolls to $34.57 in February 2024 from $33.15 in February 2023 – a 4.3% increase. This has moderated from a 4.7% increase reported a year ago but is above the 3% longer run average. Moreover, Friday morning’s reported labor force participation rate of 62.5% suggests that there is additional potential for more full-time workers to return to the labor force to ease some of these hiring pressures.

–Edward Seiler (eseiler@mba.org), Joel Kan (jkan@mba.org)