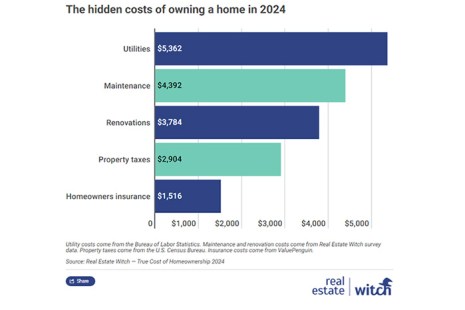

The average homeowner spends $17,958 on non-mortgage expenses, a recent study found, listing categories such as maintenance, improvements, utilities, property taxes and insurance.

Category: News and Trends

CCMS Society Kicks Off CCMS Cares Campaign

The Mortgage Bankers Association’s Commercial Certified Mortgage Servicer Society’s Philanthropic Committee has launched CCMS Cares: Supporting Families in Need, a year-long campaign seeking to support families burdened by the extraordinary expense of caring for a critically ill or injured child.

MBA Opposes Biden Administration’s Rent Control Proposal on LIHTC-Financed Multifamily Properties

MBA President and CEO Bob Broeksmit, CMB, released a statement on the Biden administration’s planned announcement to impose a 10% limit on annual rent hikes at properties supported by the Low-Income Housing Tax Credit (LIHTC).

FHFA Says Nearly 44,000 Troubled Homeowners Assisted During 4Q2023

Fannie Mae and Freddie Mac completed 43,903 foreclosure prevention actions during the fourth quarter, raising the number of homeowners who have been helped to 6.9 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

Moody’s Reports Higher Interest Rates Driving Down Defeasance

Moody’s Investors Service, New York, reported commercial mortgage-backed securities defeasance activity tumbled last year to $11.4 billion from $32.2 billion in 2022.

MBA’s Michael Fratantoni Provides Market Outlook, Notes ‘It’s Not 2008’

WASHINGTON–The industry has plentiful challenges, but is in a very different spot than during the Great Recession, said Michael Fratantoni, Mortgage Bankers Association Chief Economist and Senior Vice President of Research and Industry Technology, here at the National Advocacy Conference.

Statement of MBA’s Michael Fratantoni Before the House Financial Services Subcommittee on Housing and Insurance

Mike Fratantoni, MBA’s Chief Economist and SVP of Research and Industry Technology, testified last week at a hearing titled, “The Characteristics and Challenges of Today’s Homebuyers” before the Committee on Financial Services Subcommittee on Housing and Insurance.

Cenlar’s Tom Donatacci: The Golden Rule of Client Service

I have had a diverse, nearly 35-year career, with each chapter delivering experiences and tools that have helped me manage anything that comes my–or my client’s–way. The most significant accomplishments in my career have been when I’ve been able to surround myself with a strong team with diversified skills.

ICE First Look: Delinquencies Improve in February

Intercontinental Exchange Inc., Atlanta, released its first look at February mortgage performance, noting that the national delinquency rate was at 3.34%, down 4 basis points from the month before and 11 basis points lower than February 2023.

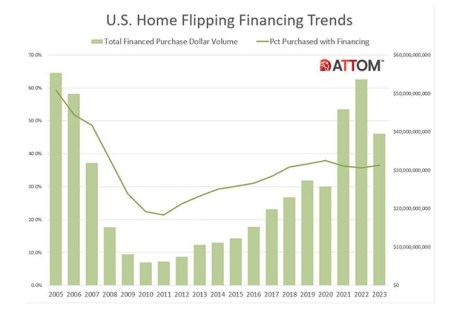

‘Home Flipping’ Plummets as Profits Slump

Home flipping fell nearly 30% in 2023 compared to the year before, according to ATTOM, Irvine, Calif.