RCN Capital, South Windsor, Conn., released its latest RCN Capital/CJ Patrick Co. Investor Sentiment Index, finding 60% of real estate investors view today’s market as better or much better than it was a year ago.

Category: News and Trends

Harvard JCHS: Remodeling Spending to Increase Slightly

After a modest downturn, homeowner expenditures for improvements and repairs are expected to trend up through the first half of 2025, the Joint Center for Housing Studies of Harvard University reported.

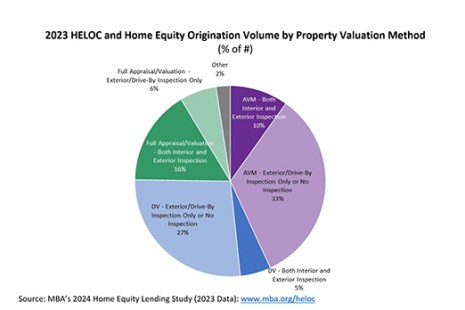

Chart of the Week: 2023 HELOC and Home Equity Origination Volume by Valuation Method

MBA recently completed its 2024 Home Equity Lending Study (covering 2023 data) tracking trends in origination and servicing operations for home equity lines of credit (HELOCs) and home equity loans.

FundingShield: Fraud Risk Still High in Q2

FundingShield, Newport Beach, Calif., released its second-quarter report, finding that 47.08% of transactions in a $74 billion portfolio including residential, commercial and business purpose loans presented some risk.

MBA: Share of Mortgage Loans in Forbearance Increases to 0.23% in June

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.23% as of June 30, 2024.

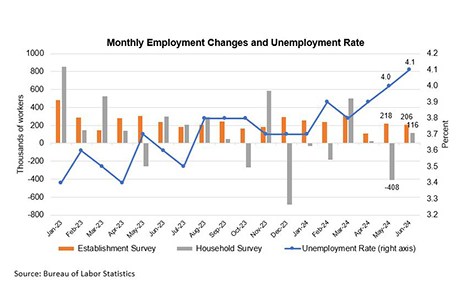

x MBA Chart of the Week: Monthly Employment Changes and Unemployment Rate

Once again, the headline gain in nonfarm payroll employment does not tell the entire story.

MBA Opposes Biden Campaign’s Nationwide Rent Control Proposal

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on President Joe Biden’s campaign proposal to cap rents nationally.

Servicing Quote Tuesday, July 16, 2024

“The Bureau’s proposal represents a substantial overhaul of the current framework, and we hope they will take into careful consideration the recommendations and feedback from our members who are serving millions of borrowers every day.”

–A joint American Bankers Association and Mortgage Bankers Association statement on a new proposed CFPB rule

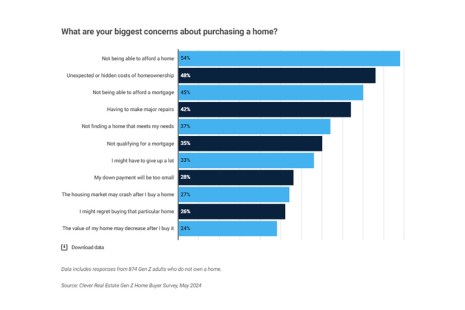

Clever Real Estate: 98% of Gen Z Sees Significant Barriers to Home Ownership

Clever Real Estate, St. Louis, released a new survey delving into Gen Z’s attitudes and expectations for home ownership, finding that 60% of the generation worries they will never own a home.

In Case You Missed It: A Look at the Second Annual mPact Summit and What’s Next

This spring, more than 100 mortgage industry professionals gathered in Plano, Texas, for a day of learning and networking, largely aimed at young and early-career participants.