RCN Capital: Real Estate Investor Sentiment Increases

(Image courtesy of RCN Capital)

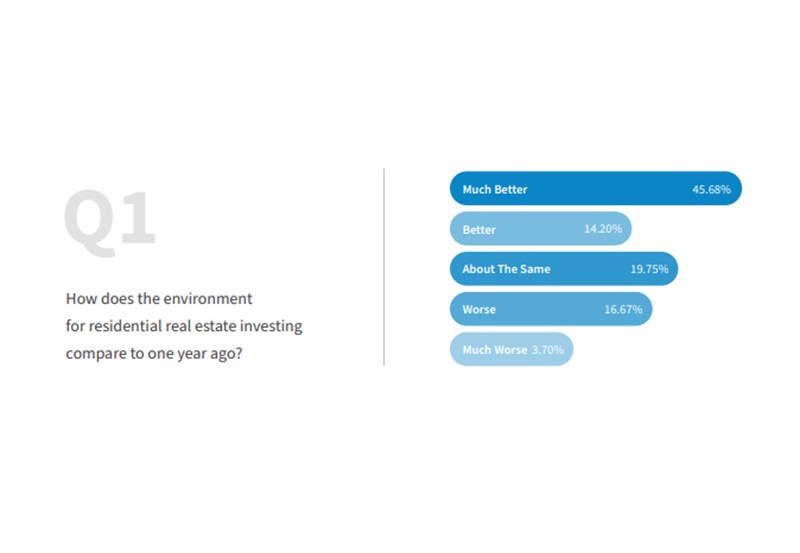

RCN Capital, South Windsor, Conn., released its latest RCN Capital/CJ Patrick Co. Investor Sentiment Index, finding 60% of real estate investors view today’s market as better or much better than it was a year ago.

Only 20% believe the current market is worse or much worse than a year ago.

Sixty-one percent expect today’s market to continue to improve, and only 14% expect it to decline. That’s the highest percentage of positive and lowest percentage of negative responses since the inception of the survey.

“Despite numerous challenges, real estate investors feel much better about the investing environment today than they have over the past year and are equally optimistic about where the market is heading,” said RCN Capital CEO Jeffrey Tesch. “Rental property investors are slightly less positive than fix-and-flip investors, which may be due to rental prices flattening and even declining in many markets across the country.”

When asked about the biggest challenges facing the real estate investing business today, high cost of financing, lack of inventory and competition from institutional investors were the top responses.

Just shy of half (48.46%) believe home prices will increase by more than 5% over the next six months; 28.4% believe they will increase by less than 5%, and 16.05% believe they will stay about the same. Small percentages believe they will decrease by any amount.

Looking specifically at insurance costs, 84% said rising insurance costs and/or the inability to insure properties is a factor in their decision to invest in real estate.

And, almost 68% said rising insurance costs and/or the inability to insure properties had caused them to miss out on an opportunity to buy or sell properties.

A full 100% of respondents who invest in California cited insurance issues as a consideration, and 73% say insurance problems had cost them a deal.

Similarly, 83% of those who invest in Florida said they are considering insurance issues, and 67% said insurance issues had caused them to miss out on an opportunity.

Looking over the next year, 48.77% of respondents intend to invest in five or fewer properties, 35.8% said six to 10, 12.04% said 11 or more and 3.4% said “other.”

For 44.14% of respondents, that’s fewer properties than they invested in over the past year, and flat for 35.49%.

Just over half–51.54%–of respondents do fix-and-flip investment as their primary type. About a third–35.49%–say they buy and hold for rental. The remaining 12.96% focus on wholesaling.