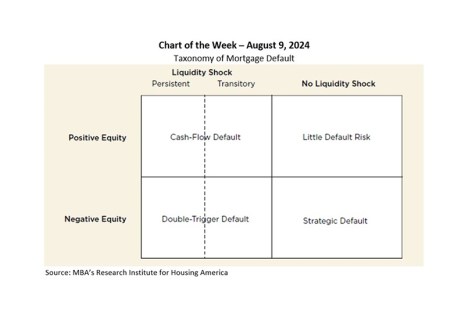

Recently, the Research Institute for Housing America (RIHA), MBA’s think tank, released a special report, Mortgage Design, Underwriting, and Interventions: Promoting Sustainable Homeownership, that looks at the lessons learned from the Great Financial Crisis, the Covid-19 pandemic, and other past episodes of default, to understand how to design a more robust mortgage system that proactively supports sustainable homeownership.

Category: News and Trends

Servicing Quote Tuesday, Aug. 6, 2024

“The study’s findings can help the industry identify current issues impacting overall housing sustainability and how to prep for future housing downturns.”

–Edward Seiler, Executive Director, Research Institute for Housing America, and MBA’s Associate Vice President, Housing Economics, on the MBA RIHA report

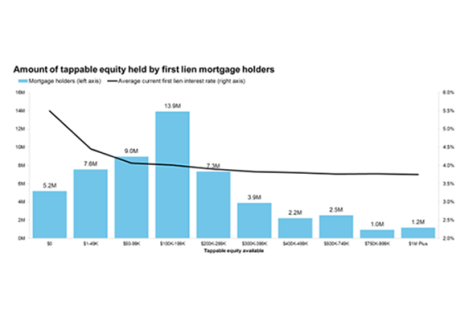

ICE Mortgage Monitor: Tappable Equity Hits Record $11.5 Trillion

Mortgage holders’ equity levels continue to reach new heights, according to Intercontinental Exchange, Inc.

MBA RIHA: Mortgage Industry Should Develop New Intervention Policies for Distressed Borrowers

According to a new research report released by the Mortgage Bankers Association’s Research Institute for Housing America (RIHA), examining current mortgage design models, underwriting standards, and intervention policies would help alleviate market pressures resulting from high levels of mortgage defaults.

USMI: 64% of Buyers With Private Mortgage Insurance Are Purchasing First Home

U.S. Mortgage Insurers, Washington, released a report finding that nearly 800,000 Americans used private mortgage insurance to purchase a home in 2023, and 64% were first-time buyers.

ATTOM: Share of Equity-Rich Homes Increases

ATTOM, Irvine, Calif., released its second-quarter 2024 U.S. Home Equity & Underwater Report, revealing that 49.2% of mortgaged residential properties in the U.S. were considered equity-rich.

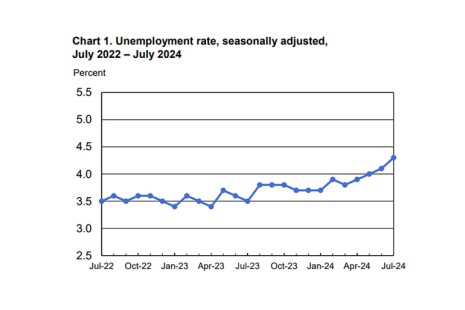

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

The job market definitively slowed in July. Nonfarm payroll growth at 114,000 was well below the 12-month average of 215,000, while the unemployment rate moved up to its highest level since October 2021 at 4.3%, as shown in this week’s chart.

Unemployment Rises to 4.3% in July

Total nonfarm payroll increased by 114,000 in July, per the U.S. Bureau of Labor Statistics.

Servicing Quote Tuesday, July 30, 2024

“Despite the tepid volume growth in 2023, our study shows an uptick in home equity debt outstanding. The elevated mortgage rate environment slowed servicing runoff, and utilization rates also increased.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

MBA: Home Equity Lending Volume Stays Relatively Flat in 2023; Debt Outstanding Increases

Total originations of open-ended Home Equity Lines of Credit (HELOCs) and closed-end home equity loans increased in 2023 by 1.5% compared to the previous year, while debt outstandings increased 8.3%.