MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

(Image courtesy of MBA)

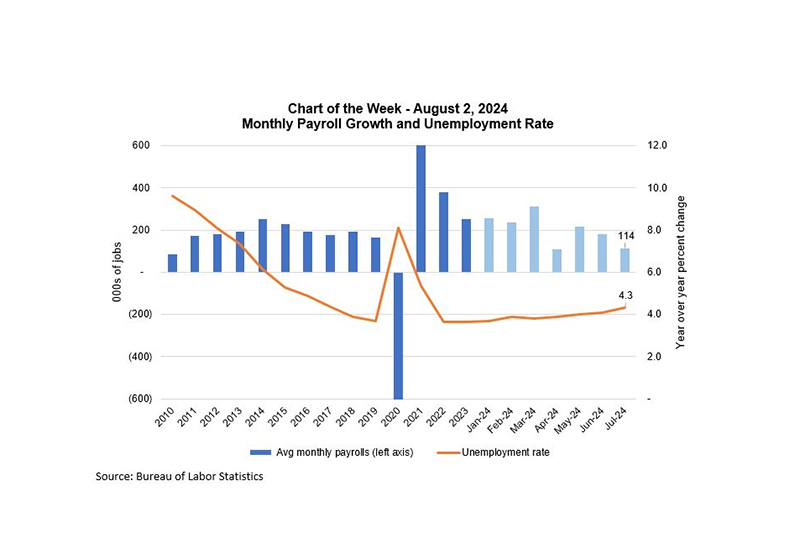

The job market definitively slowed in July. Nonfarm payroll growth at 114,000 was well below the 12-month average of 215,000, while the unemployment rate moved up to its highest level since October 2021 at 4.3%, as shown in this week’s chart.

This slowing is consistent with trends in other data, including the slower hiring rate, fewer job openings, increases in initial claims for unemployment insurance, signs of contraction in the manufacturing sector, and some signs of financial stress for households. Additionally, payroll growth for the prior two months was revised down by a cumulative 29,000 jobs.

Job growth was weak across the board, with small gains or losses across the economy. The diffusion index dipped below 50 for the third time since the Great Recession – a value of less than 50 means that fewer than half of the industry sectors added jobs or held hiring steady over the month. The broader U-6 measure, which includes unemployed and underemployed workers, showed an even bigger increase, highlighting that more people are struggling in this job market.

The Federal Reserve kept the federal funds target unchanged at its July meeting but hinted at a cut in September. The weakness in this report, including the slower rate of wage growth and the higher unemployment rate, certainly supports such a cut, but the next inflation report needs to confirm that price growth is also slowing. While the Fed still hopes for a slower rate of inflation, there is a greater risk now that keeping monetary policy overly tight for too long could lead to unnecessarily higher unemployment.

We are holding to our call for two rate cuts this year, with the first in September, as we expect that inflation will continue to moderate. Mortgage rates are now well below 7% and we expect that mortgage rates will continue to drift lower through the remainder of the year, which should support both more home purchases and refinance activity.

–Mike Fratantoni (mfratantoni@mba.org); Joel Kan (jkan@mba.org)