The Federal Housing Administration on Wednesday posted a draft Mortgagee Letter about modernizing engagement with borrowers in default. The agency seeks review and feedback.

Category: News and Trends

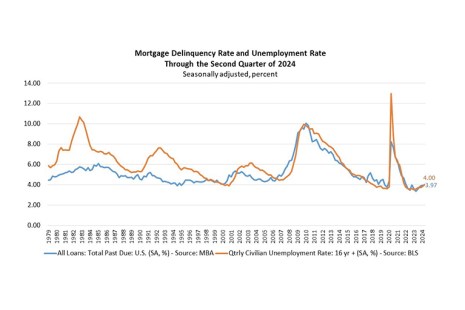

MBA: Mortgage Delinquencies Increase in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

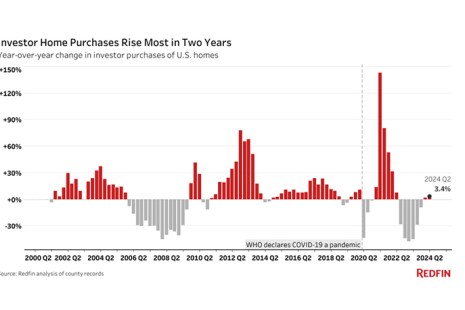

Redfin: Investor Home Purchases Post Biggest Increase Since Q2 2022

Investor purchases of homes were up 3.4% year-over-year in Q2, per Redfin, Seattle.

MBA Chart of the Week: Early-Stage vs. Seriously Delinquent Mortgage Rates

According to the latest results from MBA’s National Delinquency Survey (NDS) released last week, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter of 2024. The delinquency rate was up 60 basis points from one year ago.

Servicing Quote Tuesday, Aug. 13, 2024

“The demand slippage in late Q2 could be an early indication that local community developers buying at auction are becoming increasingly wary of rising retail inventory, which represents competition for the renovated homes they sell or rent back into the retail market — typically within six months of buying at auction.”

–Daren Blomquist, Vice President of Market Economics at Auction.com

U.S. Housing Market Nears $50 Trillion in Value, Redfin Finds

The total value of U.S homes gained $3.1 trillion over the past 12 months to reach a record $49.6 trillion, according to a new report from Redfin, Seattle.

Auction.com: Demand for Distressed Properties May Be Starting to Slow

Auction.com, Irvine, Calif., released its Q2 2024 Auction Market Dispatch, finding that demand for distressed properties sold at auction started to slip in June.

FHA Publishes Rule Regarding Modernizing Engagement with Borrowers in Default

The Federal Housing Administration on Friday published a final rule, Modernization of Engagement with Mortgagors in Default, in the Federal Register.

Home Improvements Top Reason to Tap Home Equity, Bankrate Reports

More than half of current homeowners (55%) see home improvements or repairs as a good reason to access built-up home equity, according to Bankrate, New York.

Equifax’s Craig Crabtree: Comprehensive Insights Can Lead to Better Outcomes for Lenders, Consumers and Communities

Home buyers are currently experiencing affordability challenges driven by higher interest rates, tighter inventory and elevated home prices. And the mortgage industry is seeking solutions to meet these challenges while making home loans easier and more affordable.