MBA Chart of the Week: Early-Stage vs. Seriously Delinquent Mortgage Rates

According to the latest results from MBA’s National Delinquency Survey (NDS) released last week, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter of 2024. The delinquency rate was up 60 basis points from one year ago.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.43%, down 10 basis points from one year ago. At the same time, the 90+ day delinquency rate also dropped from one year ago.

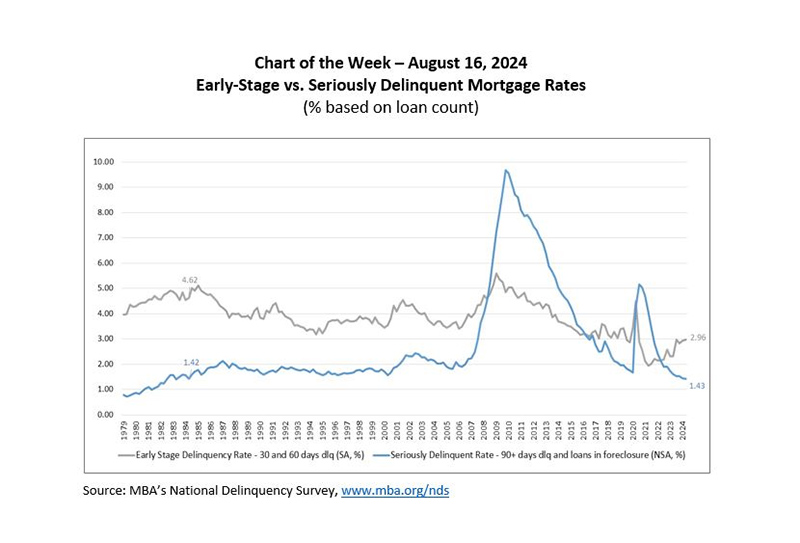

In this week’s Chart of the Week, we show the evolution in the composition of mortgage delinquencies and loans in foreclosure by stage. Early-stage delinquencies – those loans 30 days and 60 days past due – accounted for the entire delinquency increase from the previous year on a seasonally-adjusted basis. Meanwhile, seriously delinquent loans – those loans 90 days or more delinquent or in foreclosure – fell to their lowest levels since 1984.

In prior periods such as 2007-2010 and 2020-2021, an increase in the seriously delinquent rate followed an increase in the early-stage delinquency rate. But in the past year, serious delinquencies have continued to drop, even as early-stage delinquencies moved up. This suggests that homeowners were able to resolve any temporary distress on their own, or servicers were able to help at-risk homeowners avoid later-stage delinquency or foreclosure through viable loan workout options.

– Marina B Walsh, CMB (mwalsh@mba.org); Anh Doan (adoan@mba.org)