Commercial mortgage delinquencies increased in the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

Category: News and Trends

Servicing Quote Tuesday, Sept. 10, 2024

“As policymakers and elected officials consider options, MBA is leaving no stone unturned to maximize the potential of existing programs that can help narrow the gap between supply and demand. For example, we have been instrumental in bringing about a needed update and expansion of the FHA 203(k) loan program, which enables homebuyers to finance the cost of a home purchase and simultaneous renovation of that home with funds borrowed based on the after-renovation (i.e., future) value of the house.”

–MBA President & CEO Bob Broeksmit, CMB

ATTOM IDs Areas With Highest Concentration of ‘At-Risk’ Markets

ATTOM, Irvine, Calif., released a Special Housing Risk Report, highlighting that California, New Jersey/New York and Illinois are the areas with the most at-risk housing markets in the country, meaning they are more vulnerable to declines based on home affordability, underwater mortgages and other metrics.

To the Point With Bob–Amid Grand Visions, MBA is Tackling Housing Shortage One Program at a Time

The lack of affordable housing is a big issue this election year, writes MBA President and CEO Bob Broeksmit, CMB.

S&P: U.S. Insurers, Homeowners Face Greater Risks and Costs Due to Extreme Weather

U.S. insurers and homeowners face greater risks and higher costs as extreme weather events including hurricanes, wildfires and floods become more frequent and intense, according to S&P Global Ratings, New York.

Harnessing the Full Potential of the Mortgage Capital Markets–Rocktop’s Brett Benson

Imagine a day when the mortgage and other fixed-income markets operate like transparent and seamless exchanges. That’s the vision of Brett Benson, Co-President and Chief Investment Officer of Rocktop.

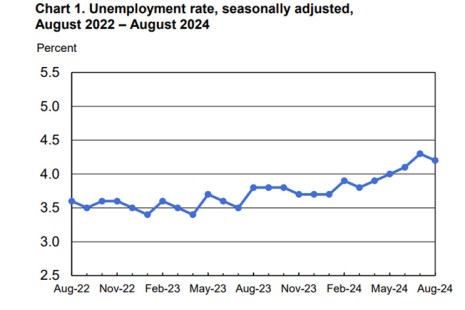

142,000 Jobs Added in August, Unemployment Rate Stagnant

The U.S. Bureau of Labor Statistics released jobs data from August, finding that total nonfarm payroll enrollment increased by 142,000. The unemployment rate changed little at 4.2%.

Chart of the Week: Payroll Growth and Unemployment Rate

The August employment report confirmed that the job market is cooling. With a 142,000 job increase in August and downward revisions of the June and July numbers, job growth has slowed to an average of 116,000 jobs over the past three months.

ICE’s Vicki Vidal: Preparing for the Proposed Regulation X Rule to Streamline Loss Mitigation

Adding to the significant changes in loss mitigation products and policies this year, the Consumer Financial Protection Bureau has published a proposed rule that revamps the current loss mitigation rules.

Adapting to Market Changes With Strong Partners [Sponsored Content From ServiceLink]

Jim Gladden identifies key characteristics to look for in your providers.