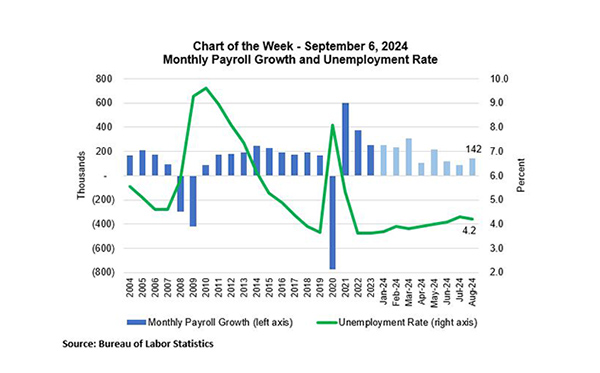

Chart of the Week: Payroll Growth and Unemployment Rate

Source: Bureau of Labor Statistics

The August employment report confirmed that the job market is cooling. With a 142,000 job increase in August and downward revisions of the June and July numbers, job growth has slowed to an average of 116,000 jobs over the past three months. The 2024 year-to-date average is 184,000 jobs per month, compared to 251,000 jobs in 2023. That is likely not enough to keep the unemployment rate from rising further. It was little changed at 4.2% in August after reaching 4.3% the previous month, but we do expect it will increase over the next year, perhaps as getting as high as 5%.

There were job losses in the manufacturing sector in August but relatively modest job gains in the services sector. This is consistent with a cooling of demand for workers from companies across the board. The diffusion index, which measures the breadth of job gains across the economy, increased but remained just over the 50 mark, which is indicative of narrower job gains at the sector level. The JOLTS report this week added to this picture with data showing an ongoing decline in job openings. A notable data point from that report showed that there is now an average of one job available for every unemployed worker, which is down from the two jobs in 2022, and this measure continues to move lower toward its historical average of 0.6. Average hourly earnings picked up last month to a 3.8% annual change from 3.6% in July.

Federal Reserve officials have recently pivoted from a primary focus on inflation to a more balanced view, with concerns both about inflation and employment. This report highlights that such a pivot makes sense, and that a 25-basis-point cut at its September meeting is a sensible first step at this time.

Mike Fratantoni (mfratantoni@mba.org), Joel Kan (jkan@mba.org)