TransUnion, Chicago, released its forecast for 2025, predicting that mortgage delinquencies will be flat a year from now in Q4 2025.

Category: News and Trends

CoreLogic: Delinquency Rate Rises Slightly in September

CoreLogic, Irvine, Calif., reported that for September, 3% of all mortgages were in some stage of delinquency.

MSCI: Insurance Taking Bigger Bite From Commercial Property Income

Higher insurance premiums are increasing commercial real estate operating costs and cutting into net operating income, according to MSCI, New York.

Chart of the Week: Unemployment by Duration

Based on the November 2024 jobs report, the unemployment rate is above 4.2%, the household survey again showed a large drop in employment, and more households reported spells of long-term unemployment, which is typically defined as being unemployed for 27 weeks or more.

Servicing Quote of the Week

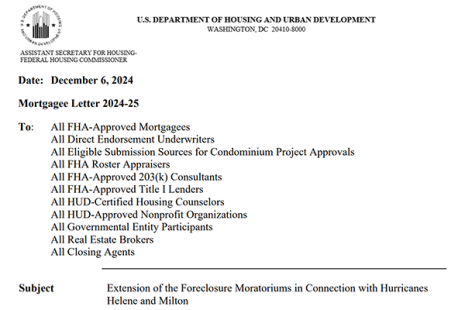

“FHA believes these foreclosure moratorium extensions are warranted because of the devastation caused by Hurricanes Helene and Milton, the extensive property damage sustained, and the reduced capacity for those impacted to access needed resources. Many areas in Florida, Georgia, North Carolina, South Carolina, Tennessee, and Virginia are deemed PDMDAs.”

–FHA letter on extending the foreclosure moratorium in connection with hurricanes Helene and Milton

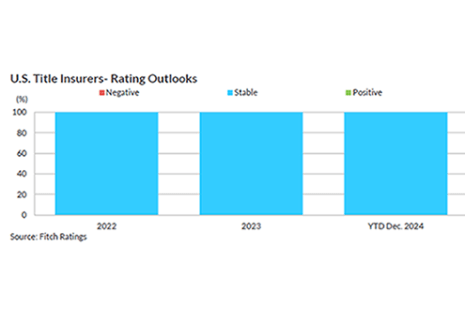

Fitch: Increased Originations Will Benefit Title Insurers in 2025

Continued housing market resiliency will benefit U.S. title insurers in 2025 as broader macro headwinds continue to subside, according to Fitch Ratings, New York.

ICE: September, October See Refinance Surge

Intercontinental Exchange Inc., Atlanta, released its Mortgage Monitor, finding that more than 300,000 refinances closed in September and October–the most in 2.5 years.

Cornerstone’s Scott Almy and Adam Laird: Success Among the Rough Mortgage Waters

The drop in mortgage business hasn’t been a sinking ship for all. Some banks remain successful and continue to prosper with their mortgage business. How were some able to weather the storm when others abandoned ship?

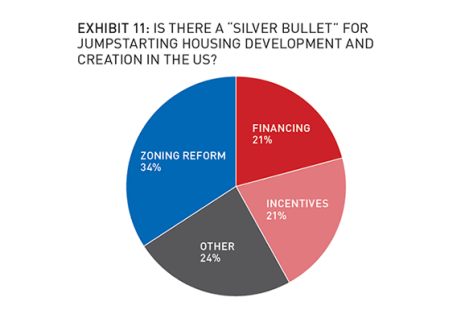

Overseas Investors Report Uncertainty, AFIRE Finds

Cross-border investment dynamics, climate change trends and zoning reform are top-of-mind for global institutional investors, according to AFIRE, the association for international commercial real estate investors.

FHA Extends Foreclosure Moratoriums for Borrowers Affected by Hurricanes Helene, Milton

The Federal Housing Administration on Friday extended the foreclosure moratoriums in connection with Hurricanes Helene and Milton through April 11, 2025.