LendingTree, Charlotte, N.C., found median property taxes in the U.S. rose by an average of 10.4% from 2021-2023. They also rose in the largest 50 U.S. metro areas during that time period.

Category: News and Trends

Redfin: Average Age of Purchased Home on the Rise

Redfin, Seattle, released a new report finding that the typical house bought in the U.S. hit a record age of 36 years in 2024.

Call for Nominations: MBA NewsLink 2025 Tech All-Star Awards

The MBA NewsLink 2025 Tech All-Star Awards nomination period is underway. Nominations are due by Friday, June 6.

MBA Weighs in on OMB Request for Information on Deregulation

The Mortgage Bankers Association weighed in yesterday on the Office of Management and Budget’s request for information on “unnecessary, unlawful, unduly burdensome, and unsound” rules.

Servicing Quote of the Week

“Home equity rates are near their highest points in recent years and the dip we’ve seen early this year in the proportion of equity-rich homes shouldn’t cause too much concern.”

–Rob Barber, CEO for ATTOM.

New Benefit for MBA Members: Perks Marketplace

Your MBA membership gets you access to discounts and offerings on our exclusive benefits platform, Perks Marketplace.

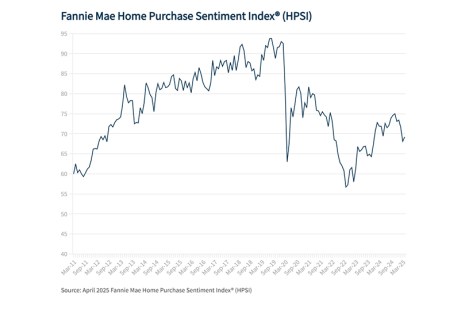

Fannie Mae: Mixed Results in Home Purchase Sentiment Index

Fannie Mae released its April 2025 National Housing Survey, including the Home Purchase Sentiment Index. The HPSI increased 1.1 points from March to 69.2, but remains down by 2.7 points year-over-year.

Premier Member White Paper Profile: SitusAMC Examines Mortgage Servicing Rights

MBA regularly highlights new white papers from its Premier Members. Today, we look at SitusAMC’s recently released Mortgage Servicing Rights in 2025: Navigating Market Volatility.

Remodeling Market Poised for Growth, NAHB Finds

Aging housing stock and insufficient new home inventory mean the remodeling market is poised for future growth, the National Association of Home Builders reported.

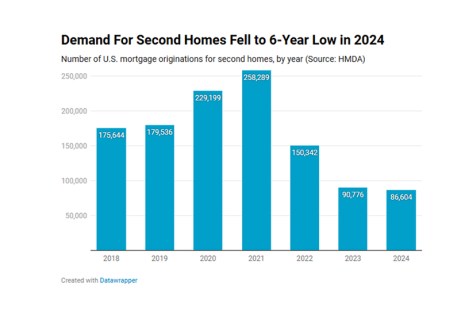

Redfin: Demand for Vacation Homes Falls

Redfin, Seattle, found that the demand for vacation and second homes has dropped to the lowest level in at least six years.