Maxwell: Many American Homeowners Stressed About Cost, Availability of Insurance

(Image courtesy of Maxwell; Breakout image courtesy of cami/pexels.com)

Maxwell, Denver, found nearly half–or 46%–of American homeowners are currently questioning whether they can continue to afford their homes due to rising insurance and property tax costs.

In fact, 90% of surveyed homeowners have seen their premiums increase over the past two years, with 44% saying they’ve seen a 10-20% increase in their monthly housing costs due to rising insurance premiums. And, 13% said they’ve seen a 20-30% hike, with 6% seeing jumps in their monthly costs of more than 30%.

“It’s clear: Homeowners insurance and taxes are taking up an increasing share of a family’s monthly housing cost,” said John Paasonen, Maxwell Co-founder and CEO. “Our survey highlights that people are worried–they’re asking how they can afford to stay in their home, even if they have a low mortgage rate, given so much uncertainty about climate and policy changes that are driving these huge monthly budget increases.”

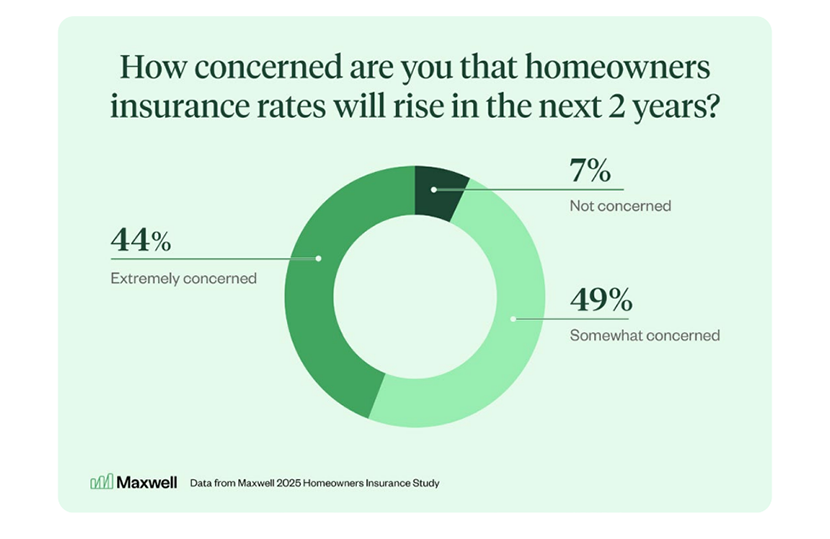

Forty-four percent say they’re “extremely concerned” that insurance premiums will continue to rise over the next two years and 49% are “somewhat concerned.”

About a quarter said they worry their insurance carriers may drop them, and 57% said if current conditions persist they “may consider” or “would strongly consider” selling their home and moving within the next five years.

Among the respondents, 5% don’t currently have a homeowners insurance policy. For those without insurance, 41% plan to set aside funds for potential property damage or loss, 26% plan to seek a new insurance carrier and 11% report wanting to move to areas deemed more insurable.

Many of these findings are strongly affected by location, as some areas have been harder hit by rising costs and availability of insurance than others. For example, 57% of homeowners in California report being worried they’ll lose coverage, compared with only 20% in Pennsylvania.