ATTOM Data Solutions, Irvine, Calif., released its Year-End 2019 U.S. Foreclosure Market Report, which showed foreclosure filings fell by 21 percent from 2018 and by 83 percent from a year ago.

Category: News and Trends

New York Fed Warns of Financial System ‘Pre-Mortem’ Cyber Risk

In a new report, the Federal Reserve of New York warns a sustained cyber attack on the U.S. financial system could result in “significant spillover” and widespread disruption.

Stanley C. Middleman: Are Non-banks Really a Systemic Risk?

The Financial Stability Oversight Council issued its annual report in December where it identified the growth of nonbank mortgage origination and servicing as a risk to the U.S. financial system. But is this really correct?

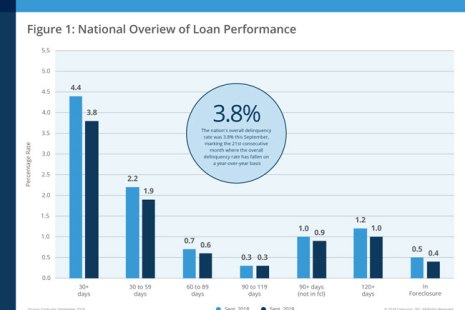

CoreLogic: October Delinquency Rate Hits 20-Year Low

CoreLogic, Irvine, Calif., reported 3.7% of mortgages were in some stage of delinquency in October, an 0.4 percentage point decline from a year ago.

FHFA: Nearly 4.4 Million Homeowners Helped Since Conservatorship

The Federal Housing Finance Agency released its quarterly Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 26,475 foreclosure prevention actions in the third quarter, bringing the total number of foreclosure prevention actions to 4.38 million since September 2008.

New Regulations in VA Loans Promotes Clear Processes, Enhances Veteran Education About Home Financing and Refinancing

After the financial crisis in 2008, many veterans looked for new options in financing and refinancing for their homes. Veteran Affairs loans can cost much less for veterans and active military personnel – one of the more widely discussed advantages of veteran loan programs.

Buying More Affordable than Renting in 53% of Housing Markets

ATTOM Data Solutions, Irvine, Calif., said its 2020 Rental Affordability Report showed owning a median-priced, three-bedroom home is more affordable than renting a three-bedroom property in 455, or 53 percent, of the 855 U.S. counties analyzed.

Homeland Security, New York DFS Issue Warnings on Potential Iran Cybersecurity Breaches

In the wake of the U.S. military drone strike against the leader of Iran’s special operations forces earlier this month, the Department of Homeland Security, as well as the New York Department of Financial Services, issued warnings about potential Iranian cybersecurity threats targeting U.S. businesses, particularly financial institutions.

HUD Issues New Proposed Fair Housing Rule

HUD last week published its proposed Affirmatively Furthering Fair Housing rule, which it said is intended to offer “clearer guidance” to states and local governments to help them improve affordable housing choices in their community.

U.S. Population Growth Continues to Slow

Data released by the U.S. Census Bureau shows 42 states and the District of Columbia had fewer births in 2019 than 2018, while eight states saw a birth increase. With fewer births in recent years and the number of deaths increasing, natural increase (or births minus deaths) has declined steadily over the past decade.