The Mortgage Bankers Association reported commercial/multifamily mortgage debt outstanding at the end of 2019 rose by $248 billion (7.3 percent) from a year ago.

Category: News and Trends

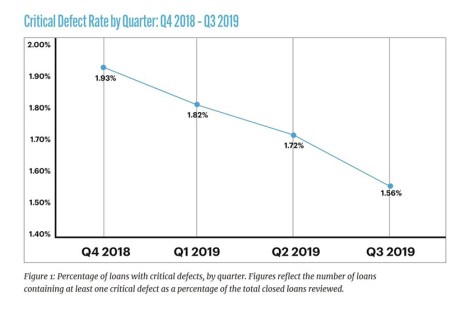

ARMCO: Critical Defect Rate Drops 9%

ACES Risk Management, Denver, said the overall critical defect rate reached 1.56% in the third quarter, to the lowest defect rate since 2016.

House Committee Asks Regulators, Financial Institutions to Report on Coronavirus Actions

House Financial Services Committee Chair Maxine Waters, D-Calif., sent a letter to Administration officials, regulators and financial services organizations (including MBA President and CEO Robert Broeksmit, CMB, and credit reporting agencies expressing concerns about risks related to the coronavirus pandemic and steps they are taking to prevent Americans and the financial system from being harmed.

MBA, Trade Groups Give HUD Feedback on CWCOT Program

The Mortgage Bankers Association, the Housing Policy Council and the National Mortgage Servicing Association submitted joint comments to HUD on its proposed enhancements to its Claims Without Conveyance of Title (CWCOT) Program).

FHFA Updates Evaluation Criteria for Duty to Serve Program

The Federal Housing Finance Agency yesterday announced modifications to evaluation criteria of its Duty to Serve Underserved Markets program for Fannie Mae and Freddie Mac.

Survey: ¾ of Homeowners Say Mortgage Negatively Affects Ability to Save

Seventy-seven percent of U.S. mortgage holders say the size of their mortgage has a negative impact on their ability to save money for the future, according to a survey by Bankrate.com, New York.

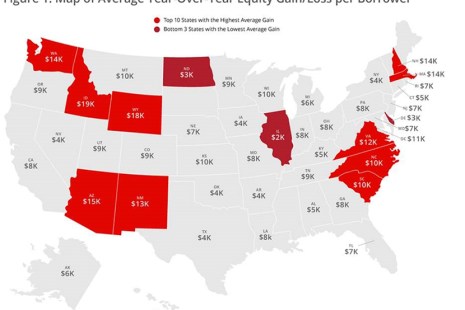

Nearly 100,000 Homeowners Regained Positive Equity in Fourth Quarter

CoreLogic, Irvine, Calif., said the number of Americans with negative equity in their homes fell to the lowest level since before the Great Recession, with 96,000 homeowners regaining equity in the fourth quarter.

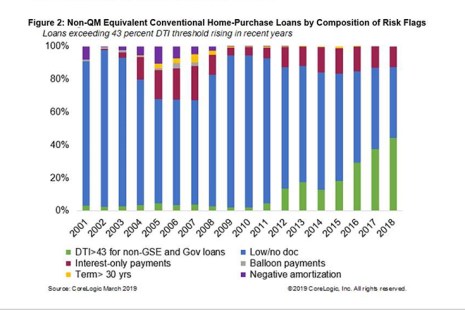

Portfolio Risk Management: Repurchase Risk for Non-QM Mortgages

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure. R&W agreements often require the issuer of mortgages to repurchase the loans and make whole the investors if the loans are found to breach the seller guidelines.

CoreLogic: December U.S. Delinquency Rate Lowest in 20 Years

CoreLogic, Irvine, Calif., reported just 3.7% of mortgages in some stage of delinquency in December, the lowest for a December in more than 20 years.

MBA, Trade Groups Urge Congress to Ban GSE G-Fee Offsets

The Mortgage Bankers Association and nearly three dozen other industry trade groups, in a Mar. 6 letter to House and Senate leadership, urged Congress to continue to prevent use of Fannie Mae and Freddie Mac guarantee fees as a source of funding offsets.