Nearly 100,000 Homeowners Regained Positive Equity in Fourth Quarter

CoreLogic, Irvine, Calif., said the number of Americans with negative equity in their homes fell to the lowest level since before the Great Recession, with 96,000 homeowners regaining equity in the fourth quarter.

The company’s quarterly Home Equity Report for the fourth quarter said homeowners with mortgages (63% of all properties) have seen their equity increase by 5.4% year over year, representing a gain of nearly $489 billion since fourth quarter 2018.

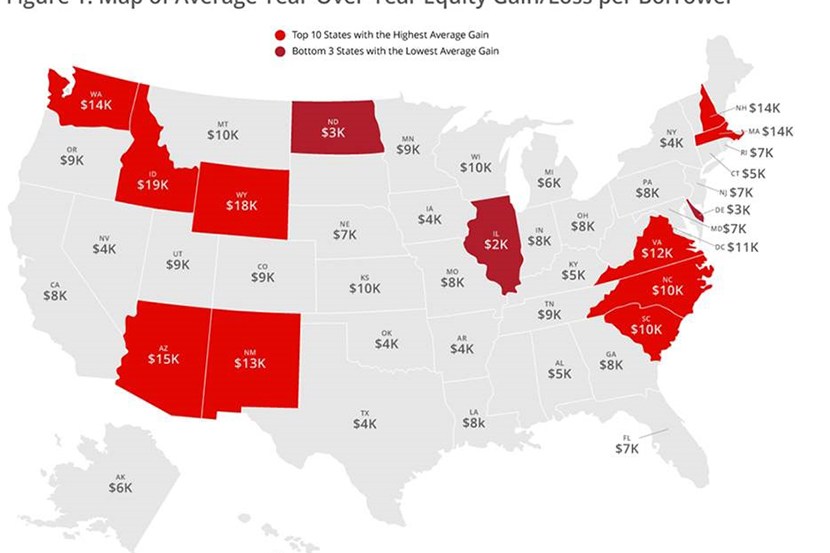

The report said the average homeowner gained $7,300 in home equity over the past year. States with the largest gains include Idaho, where homeowners gained an average of $18,700; Wyoming, where homeowners gained an average of $17,900; and Arizona, where homeowners gained an average of $14,800.

From the third quarter to the fourth quarter, the total number of mortgaged homes in negative equity decreased by 4.8% to 1.9 million homes, or 3.5% of all mortgaged properties. The number of mortgaged properties in negative equity during the fourth quarter fell by 15%, or 330,000 homes, compared to a year ago, when 2.2 million homes, or 4.2% of all mortgaged properties, were in negative equity.

“[The Index] recorded a quickening of home price gains during the fourth quarter of 2019, helping to boost home equity wealth,” said Frank Nothaft, chief economist for CoreLogic. “The average family with a mortgage had a $7,300 gain in home equity during the past year, and a total of $177,000 in home equity wealth.”

The report said negative equity peaked at 26% of mortgaged residential properties in fourth quarter 2009. The national aggregate value of negative equity reached $283 billion at the end of the fourth quarter , down quarter over quarter by $19.9 billion, or 6.6%, from $302.6 billion in the third quarter and down year over year by $20.4 billion, or 6.7%, from $303 billion.

“Western states and those in the mid-Atlantic region are registering strong gains, compared to states in the Northeast and upper Midwest,” said Frank Martell, president and CEO of CoreLogic. “With unprecedented low rates and constrained supply, the housing market should continue to do well. Viewed against the backdrop of the recent stock market volatility, steady gains in home equity are a welcome source of stability.”