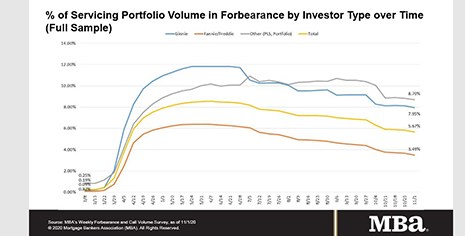

“With declines in the share of loans in forbearance across the board, the data this week align well with the positive news from October’s jobs report, which showed a gain of more than 900,000 private sector jobs and a 1 percentage point decrease in the unemployment rate. A recovering job market, coupled with a strong housing market, is providing the support needed for many homeowners to get back on their feet.”

–MBA Senior Vice President and Chief Economist Mike Fratantoni.