KBRA just released its 2021 Sector Outlook: CMBS: Slow and Steady report. As the real estate finance industry grapples with increased infection rates approaching the holiday season and how to think about 2021, MBA NewsLink sat down with KBRA’s Patrick McQuinn and Sacheen Shah to get their insights.

Category: News and Trends

FHFA Holds 2021 Deemed-Issuance Ratio for UMBS at 60/40

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.

The Wonder Years: Freddie Mac’s K Series Turns 11

Freddie Mac’s K series quietly holds a place as an important, innovative multifamily market solution that has served borrowers, lenders, tenants and bondholders extremely well since its inception. Importantly for a government-sponsored entity, it also serves as a mechanism to transfer risk away from taxpayers.

CMBS Special Servicing Rate Slips; Issuance Could Bounce Back in 2021

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate inched down in October after peaking in September.

FHFA: 2021 GSE Conforming Loan Limits Increase to $548,250

The Federal Housing Finance Agency on Nov. 24 announced a nearly $40,000 jump in maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021.

Quote

“While estimating future issuance is always a challenge, the current environment is making any projections extremely difficult…a lack of demand for hotel and non-essential retail will continue to keep CMBS issuance from the growth seen in years prior to the pandemic.”

–Patrick McQuinn, Senior Director with KBRA’s CMBS new-issuance group.

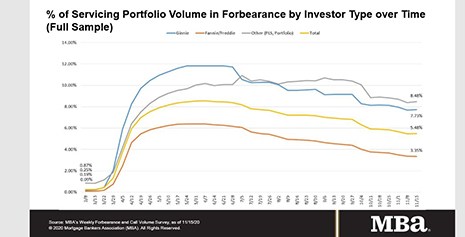

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

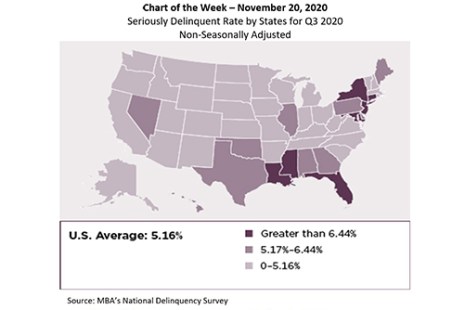

MBA Chart of the Week: Seriously Delinquent Rate by States for Q3 2020

This week’s chart highlights the seriously delinquent rate – the percentage of loans that are 90 days or more delinquent or in the process of foreclosure – in every state across the country.

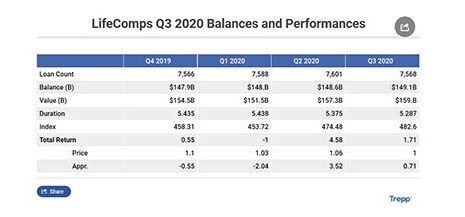

Life Insurance Commercial Mortgage Returns Stabilize, Credit Concerns Remain

Trepp, New York, said returns for life insurance commercial mortgages stabilized in the third quarter, but noted credit concerns remain.

Quote

“While a revised capital framework for the GSEs is a necessary step to ensure their safety and soundness, we are disappointed with several aspects of the final rule…given that this rule will affect both the cost and availability of mortgage credit for borrowers, we believe FHFA should conduct a quantitative impact study to determine the full impact of the rule.”

–MBA President & CEO Robert Broeksmit, CMB, responding to a Federal Housing Finance Agency final rule on a capital framework for Fannie Mae and Freddie Mac.