FHFA Holds 2021 Deemed-Issuance Ratio for UMBS at 60/40

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.

The deemed-issuance-ratio will be used for diversification reporting on bonds ultimately delivered to the purchaser until the bonds have been disposed of, regardless of the issuing Enterprise (Fannie Mae or Freddie Mac) on the underlying bonds.

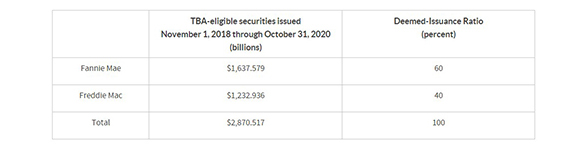

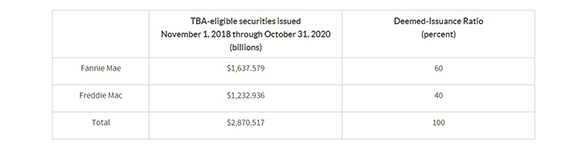

The IRS Revenue Procedure 2018-54 provides that the ratio may be rounded as long as the rounded ratio is further from 50/50 than the actual observed data. Therefore, FHFA determined the deemed-issuance ratio for the 2021 calendar year is 60 percent Fannie Mae and 40 percent Freddie Mac.

The IRS procedure provides guidance on section 817(h) of the Internal Revenue Code diversification requirements for variable annuity, endowment and life insurance contracts. The IRS has provided a deemed-issuance-ratio to allocate issuer exposure for TBA trades between the Enterprises. Compliance with these requirements is affected by the implementation of and trading in UMBS.

Revenue Procedure 2018-54 calls for FHFA to determine a deemed-issuance ratio for each calendar year based on the ratio of TBA-eligible securities issued by Fannie Mae and Freddie Mac during the 24-month period ending October 31 of the preceding year.

FHFA plans to announce the ratio annually at least three weeks prior to the affected calendar year.