December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

Category: News and Trends

3Q Home Flipping Drops but Profits Reach Record High

ATTOM Data Solutions, Irvine, Calif., said home flipping fell in the third quarter from both the second quarter and a year ago, but profits—and profit margins—jumped to record highs.

FHFA: GSE Non-Performing Loan Portfolios Down 70%

The Federal Housing Finance Agency’s latest report on sale of non-performing loans by Fannie Mae and Freddie Mac showed of loans one or more years delinquent held in the Enterprises’ portfolios decreased by 70 percent.

Quote

“The need for continued access to CARES Act forbearance past the end of this calendar year is evident from the growing infection counts and associated economic disruption across the country. As such, we urge the agencies to publicly announce that the COVID-19 forbearance programs will continue to be available through the National Emergency period, allowing sufficient time for borrowers to access this assistance and servicers to plan for continued program delivery over the coming months.”

–From an MBA/trade group letter to federal agencies asking for a consistent timeframe for CARES Act forbearance.

MBA, Trade Groups Urge Treasury to Promote ‘Critical Reforms’ of GSEs

More than 12 years after the federal government placed Fannie Mae and Freddie Mac under conservatorship—and seemingly no closer to moving them out of conservatorship—the Mortgage Bankers Association and several industry trade groups urged the Treasury Department to promote “critical reforms” of the GSEs and bolster their safety and soundness.

MBA: 3Q Commercial/Multifamily Mortgage Debt Up 1.5%

Commercial/multifamily mortgage debt outstanding rose by $57.0 billion (1.5 percent) in the third quarter, the Mortgage Bankers Association reported this morning.

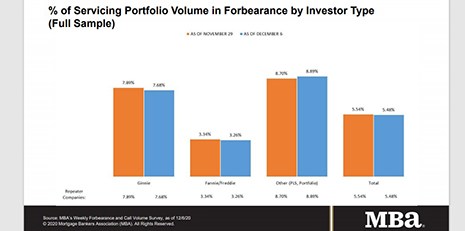

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Quote

“MBA applauds the Bureau for releasing the final General and Seasoned QM rules. The revisions to these rules will preserve and expand responsible access to affordable credit while retaining core consumer protections. In particular, these rules remove cumbersome requirements for non-traditional sources of income and expand consumers’ choices. MBA appreciates the Bureau’s effort to seek stakeholder input, and we look forward to continuing to work together on other issues aimed at protecting consumers.”

–MBA President & CEO Robert Broeksmit, CMB.

Scott Colclough: Amidst Uncertainty, Hedging Still Works

By maintaining a prudent hedging strategy constructed using mortgage-backed securities, mortgage lenders can match market movement on the value of borrower locks to the market in which the locks were taken.

Andrew Foster: Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year.