it’s inevitable that the market will shift—and it’s not too soon to prepare. And just as outsourcing has helped many originators overcome unprecedented capacity issues while volumes are high, it may again prove to be the best strategy for organizations transitioning to the next market environment.

Category: News and Trends

Quote

“MBA appreciates that FHFA has coordinated with the various government-backed loan providers to align Fannie Mae’s and Freddie Mac’s COVID-19 mortgage relief policies. The enhanced forbearance provisions will provide borrowers with the same options and allow mortgage servicers to streamline their offerings to provide relief for homeowners.”

–MBA President & CEO Robert Broeksmit, CMB.

MBA: Share of Mortgage Loans in Forbearance Declines to 5.22%

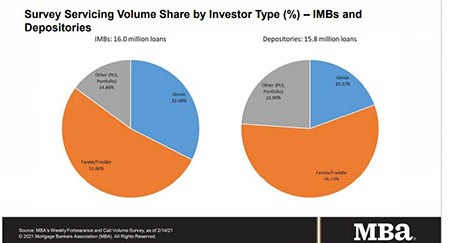

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 5.22% of servicers’ portfolio volume as of Feb. 14 compared to 5.29% the prior week. MBA estimates 2.6 million homeowners remain in forbearance plans.

Anita Bush: Effective Forbearance Management for Mortgage Loan Servicers

In this article, we’ll address some of the servicer’s legal requirements and offer three keys to success intended to help servicers manage the post-forbearance process.

Hotels Lenders, Investors Express Growing Optimism

After a difficult 2020 for the hotel sector, some hospitality lenders and investors are expressing optimism about 2021.

Fitch Ratings: Solid U.S. RMBS Market Faces Uncertainty

Fitch Rating, New York, said the new-issue private-label U.S. residential mortgage-backed securities market is humming along at a solid pace, though it says some broader developments in the coming year could influence the pace of new deals.

MBA Letter Offers Recommendations on Improving CRA Framework

The Mortgage Bankers Association, in a letter last week to the Federal Reserve, offered recommendations on how the Fed could improve the Community Reinvestment Act to improve credit access and more effectively meet the needs of low- and moderate-income communities.

FHFA Releases 2021 Scorecard for GSEs, Common Securitization Solutions

The Federal Housing Finance Agency last week released the 2021 Scorecard for Fannie Mae, Freddie Mac and Common Securitization Solutions. The 2021 Scorecard aligns the 2019 Strategic Plan with the Enterprises’ tactical priorities and operations, serving as an essential tool to hold the Enterprises accountable.

Biden Administration Extends, Expands Forbearance/Foreclosure Relief Programs

The Biden Administration yesterday announced a coordinated extension and expansion of forbearance and foreclosure relief programs. The programs, set to expire at the end of March, have now been extended through June 30.

Quote

“The share of loans in forbearance has declined for three weeks in a row, with portfolio and PLS loans decreasing the most this week. This decline was due to a sharp increase in borrower exits, particularly for IMB servicers. Requests for new forbearances dropped to 6 basis points, matching a survey low.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.