Hotels Lenders, Investors Express Growing Optimism

After a difficult 2020 for the hotel sector, some hospitality lenders and investors are expressing optimism about 2021.

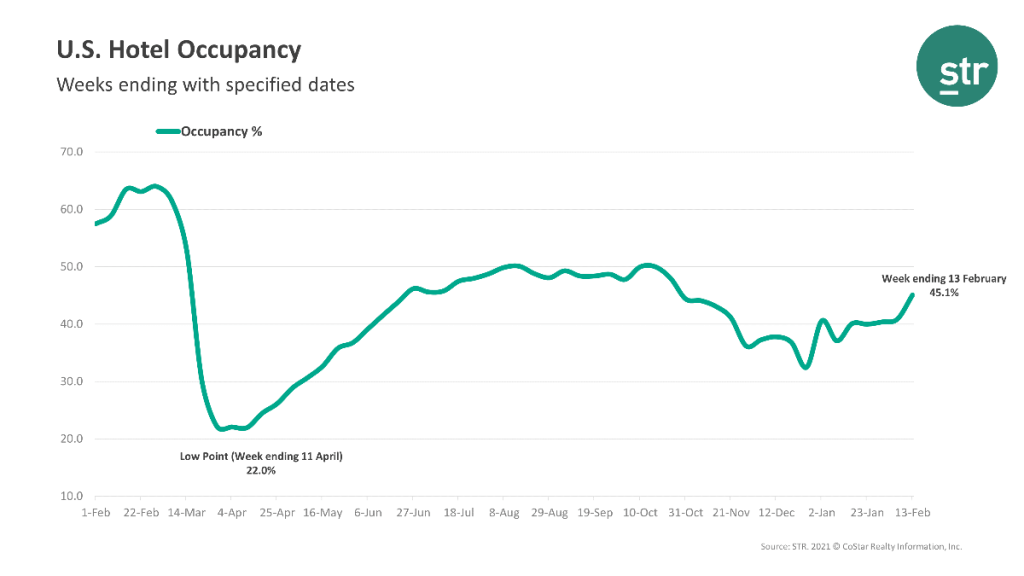

STR, Hendersonville, Tenn., reported U.S. hotels in 2020 suffered the worst annual occupancy level last year since the Great Depression (an assertion confirmed Thursday when Marriott International announced a $267 million loss in 2020–its first annual loss since 2009).

However, STR said despite the gloomy 2020, this year is cautiously promising. “While the ongoing pandemic certainly appeared to influence almost every lender response, the outlook for 2021 and beyond is optimistic and signals more liquidity in hotel lending markets over the coming months,” STR said.

Hospitality investment-banking firm RobertDouglas, New York, said hotel lenders it surveyed believe 2021 will be better than last year. In 2020 nearly every lender hit the pause button on new hotel originations and hotel valuations declined almost overnight, but 63 percent of lenders surveyed in January expressed confidence in future hotel performance and more than 65 percent said they expect hotel lending volumes and values to increase over the next 12 months.

JLL Hotels & Hospitality, Chicago, found another cause for optimism: more non-traditional investors are now considering hotel assets.

“Private equity groups and high-net-worth individuals will continue to be active investors of hotel assets in 2021,” JLL said. The firm’s Hotel Investment Outlook report said $24.5 billion in capital was raised in closed-end funds targeting hotel and hospitality assets globally, matching 2016 levels. “Additionally, all regions globally are seeing a flurry of fundraising activity with opportunistic capital ready to mobilize on distressed assets, allowing non-traditional investors to get a piece of the lodging pie at a competitive price. This trend is expected to drive the bulk of liquidity in 2021.”

The sector’s road to recovery will be long, but JLL found reason for optimism that pent-up demand to re-experience the world will gradually boost hotel performance across most markets. “Once recovered, hotels should look and feel much different than they did at the beginning of 2020,” the report said.