Smart originators are already thinking about how to generate business when the refi dust settles. And many are setting their sights on the real estate investor channel, because the opportunities for business growth are incredible.

Category: News and Trends

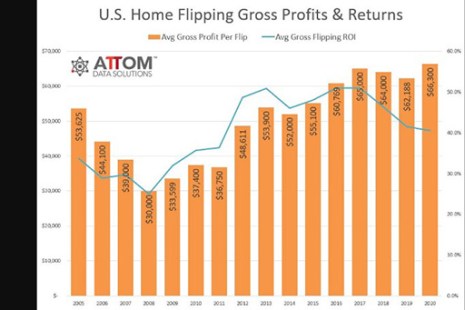

Yearly Home Flipping Sales Fall for 1st Time Since 2014

ATTOM Data Solutions, Irvine, Calif., reported a sharp decline in home flipping in 2020, the first decline since 2014 to the lowest level in nearly five years.

MBA RIHA Study: Affordability Growing Challenge for Low-, Moderate-Income Renters in Majority of Top 50 Metro Areas

Home prices and rent appreciation have exceeded income growth since the turn of the 21st century. This has created economic obstacles for many American households, especially for low- and moderate-income renters living in cities with recent employment growth but significant housing supply constraints.

Positive Signs Even as Many Household Incomes Still Negatively Impacted by COVID-19

U.S. consumers continue to be negatively impacted one year since the onset of COVID-19, although TransUnion, Chicago, reported positive signs in its latest Consumer Pulse study.

MBA: Commercial/Multifamily Mortgage Debt Up 5.8 Percent in Fourth Quarter

Commercial/multifamily mortgage debt outstanding at the end of 2020 rose by $212 billion (5.8 percent) from the previous year, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report said.

Quote

“There is a significant lack of affordable housing supply in the United States, and the problem is worsening. In 2001, a low- and moderate-income household could spend less than 30% of its income to rent the median rental unit in 38 of the largest 50 metro areas. By 2020, this was the case in only 17 metro areas.”

–Michael Eriksen, author of a RIHA report examining affordability challenges for low- and moderate-income renters.

Sen. Toomey Issues Housing Finance Reform Principles

Sen. Pat Toomey, R-Pa., ranking member of the Senate Banking Committee, yesterday released a set of guiding principles for housing finance reform, a move welcomed by the Mortgage Bankers Association.

MBA Expresses Concerns over GSE Limits on Second Homes, Investor Properties

The Mortgage Bankers Association said it is concerned over new limits on loan deliveries for second homes and investor properties by Fannie Mae and Freddie Mac.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

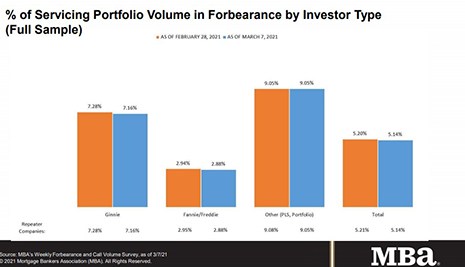

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.14%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 5.14% of servicers’ portfolio volume as of March 7 from 5.20% the prior week. MBA estimates 2.6 million homeowners are in forbearance plans.