Fitch Ratings, New York, said rental assistance provided under the American Rescue Plan will help renters and multifamily property landlords, but the extent to which the ARP can keep delinquencies low is uncertain, as the amount of unpaid back rent is difficult to estimate due to lack of data.

Category: News and Trends

SCOTUS Ruling Supports MBA Interpretation of TCPA ‘Autodialer’ Definition

The U.S. Supreme Court unanimously ruled Thursday that a statutory definition of what constitutes an “autodialer” was overly broad, giving Facebook and a number of businesses, including the Mortgage Bankers Association, a decisive legal victory.

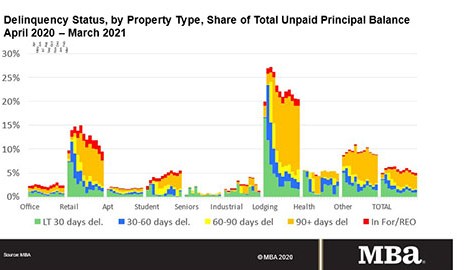

MBA: March Commercial/Multifamily Mortgage Delinquencies Fall for 3rd Straight Month

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in March, reaching the lowest level since the onset of the COVID-19 pandemic, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

Hotel Debt Markets Improving

The hospitality debt market is showing a resurgence as the lodging industry continues to recover, said JLL, Chicago.

HUD: FHA Mutual Mortgage Insurance Fund Programs on Track; No Plans to Change Premiums

HUD released its quarterly report to Congress on the FHA Single-Family Mutual Mortgage Insurance Fund Programs. The report said the MMIF stands at more than $80 billion and remains well above the 2% minimum capital reserve required by Congress.

A Conversation with MBA Affordable Housing Advisory Council Co-Chairs

The Mortgage Bankers Association recently created two Affordable Advisory Councils, dedicated to supporting CONVERGENCE, the MBA Affordable Housing Initiative. These Councils are currently led by four senior executives: Christine Chandler (M&T Realty Capital Corp.), Tony Love (Bellwether Affordable Housing Group), Anthony Weekly (Truist Bank) and David Battany (Guild Mortgage).

Quote

“While we commend the Bureau for its willingness to take proactive steps to mitigate the effects of the COVID-19 pandemic on the housing finance system, we do not support the proposal to delay the General QM Final Rule’s mandatory compliance date, as it will not expand access to credit and will inject considerable uncertainty into the housing market.”

–MBA President & CEO Robert Broeksmit, CMB, in a letter to the Consumer Financial Protection Bureau expressing concern over a proposed delay in implementing its General Qualified Mortgage final rule.

Fannie Mae Updates Servicer Toolkit

Fannie Mae, Washington, D.C., last week updated its Servicer Toolkit, providing new content and resources for mortgage servicers.

CDC Extends National Eviction Moratorium to June 30

The Centers for Disease Control and Prevention announced yesterday an extension to the eviction moratorium further preventing the eviction of tenants who are unable to make rental payments. The moratorium that was scheduled to expire on March 31 is now extended through June 30.

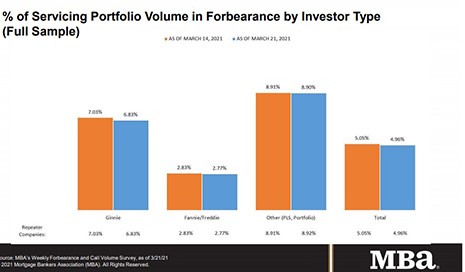

MBA: Share of Loans in Forbearance Hit Pandemic-Era Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 9 basis points to 4.96% of servicers’ portfolio volume as of March 21 from 5.05% the week before. This marks the fourth consecutive week of decreases. MBA estimates 2.5 million homeowners are in forbearance plans.