When the full effects of the coronavirus pandemic began hitting in March 2020, the Mortgage Bankers Association quickly realized that life as usual—and business as usual—could take a long time to return to “normal.”

Category: News and Trends

Millennials, Gen Z More Than Twice as Likely to Delay Financial Milestone Due to COVID-19

Although an increasing number of U.S. adults have been vaccinated and look forward to resuming pre-pandemic activities, a new Bankrate.com survey indicates that nearly two in five (39%) individuals have delayed a financial milestone because of the pandemic.

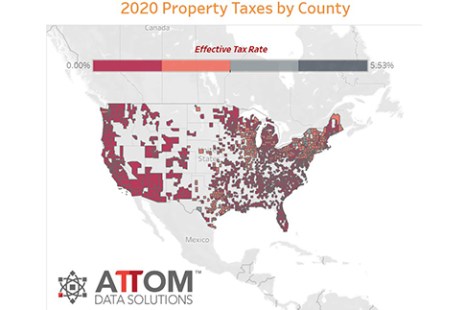

ATTOM: 2020 Single-Family Property Taxes Rise 5.4% to $323B

Single-family homeowners saw their property taxes rise on average by 5.4 percent in 2020, to a nationwide total of $323 billion, reported ATTOM Data Solutions, Irvine, Calif.

CFPB Proposes Delay for Debt Collection Rules

The Consumer Financial Protection Bureau on Wednesday proposed extending the effective date of two recent debt collection rules to give affected parties more time to comply due to the ongoing COVID-19 pandemic.

Quote

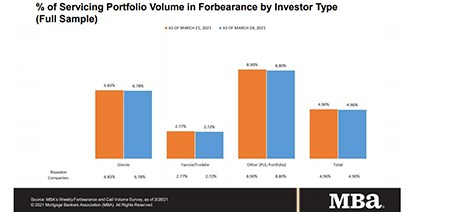

“The accelerating economic recovery in March helped more homeowners recover and become current on their mortgages, in addition to helping other homeowners with more stable financial situations exit forbearance.”

–MBA Chief Economist Mike Fratantoni.

Sponsored Content from Black Knight: Servicing Technology in the Era of COVID-19 Regulations

In today’s evolving regulatory environment, servicers need advanced technology to help them address compliance, manage deadlines and support consumers.

CFPB Proposes Mortgage Servicing Changes

The Consumer Financial Protection Bureau yesterday proposed a set of rule changes it said are intended to help prevent “avoidable foreclosures” as emergency federal foreclosure protections expire.

MBA: Share of Loans in Forbearance Hits Pre-Pandemic Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 4.90% of servicers’ portfolio volume as of March 28 from 4.90% the prior week–the fifth consecutive weekly drop and the lowest level in more than a year. MBA estimates 2.5 million homeowners remain in forbearance plans.

MBA Urges No Delay to CFPB QM Final Rule

The Mortgage Bankers Association, in a letter yesterday to the Consumer Financial Protection Bureau, urged the Bureau not to delay the effective date of its new General Qualified Mortgage Rule, saying the Bureau’s rationale for delaying the rule would not accomplish its stated goals nor benefit consumers.

CFPB Issues Blunt Warning to Mortgage Servicers: ‘Unprepared is Unacceptable’

The Consumer Financial Protection Bureau last week warned mortgage servicers to “take all necessary steps now” to prevent a wave of avoidable foreclosures this fall.