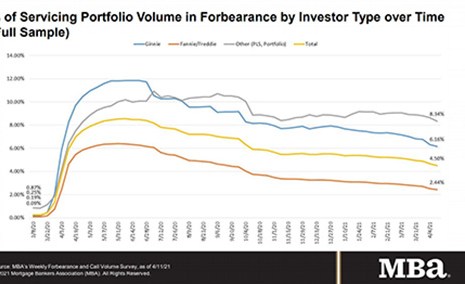

“Commercial and multifamily mortgage delinquency rates declined in April but remain elevated overall, driven by the continuing challenges facing many hotel and retail properties.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.