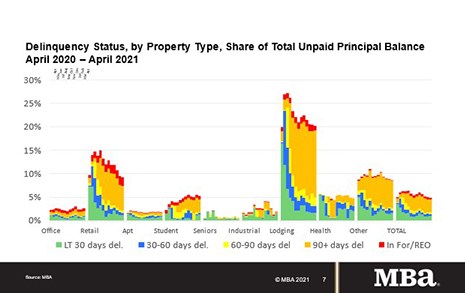

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in April, reaching the lowest level since the onset of the COVID-19 pandemic, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Category: News and Trends

CFPB: Consumer Complaints Higher in Predominantly Minority Areas

The Consumer Financial Protection Bureau issued a bulletin this week analyzing complaints submitted by consumers in counties nationwide. The Bureau reported in 2019 and 2020, it received more complaints on a per-capita basis from consumers living in predominantly minority counties than from consumers in predominantly white, non-Hispanic counties.

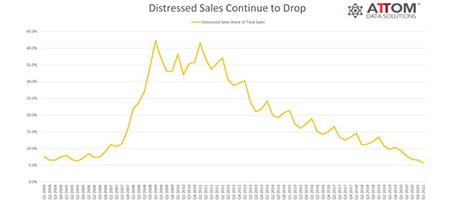

1Q Home Seller Profits Dip, But Remain Higher than Year Ago

ATTOM Data Solutions, Irvine, Calif., said profits for home sellers nationwide fell slightly in the first quarter but improved year over year—another sign of how the housing market is fending off economic damage caused by the coronavirus pandemic.

FHFA Announces New Refi Option for Low-Income Borrowers with GSE-Backed Mortgages

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will implement a new refinance option for low-income borrowers with government-sponsored enterprise-backed single-family mortgages.

CFPB Formally Delays QM Final Rule Compliance Date to Oct. 2022

The Consumer Financial Protection Bureau yesterday formally delayed the mandatory compliance date of its General Qualified Mortgage final rule to October 1, 2022.

CMBS Supply-Demand Fundamentals Dip

Moody’s Investors Service, New York, said the supply and demand outlook for most property types in the securitized commercial real estate market dipped in fourth-quarter 2020.

Quote

“Commercial and multifamily mortgage delinquency rates declined in April but remain elevated overall, driven by the continuing challenges facing many hotel and retail properties.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

MBA Releases Templates for Servicer Communications with Existing ARM Borrowers in Preparation for LIBOR Expiration

The Mortgage Bankers Association this week released two templates for residential mortgage servicers’ communications with borrowers with existing London Interbank Offered Rate (LIBOR)-indexed adjustable-rate mortgages.

#MBASpring21: Administration Acknowledges Issues with GSE Product Caps

During the final months of the Trump Administration, the Federal Housing Finance Agency implemented product caps on Fannie Mae and Freddie Mac through their Senior Preferred Stock Purchase Agreements—a move that the Mortgage Bankers Association called “disruptive” for many of its members.

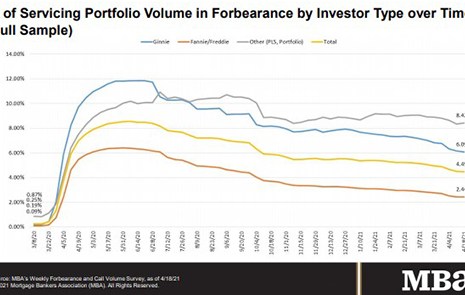

MBA: Share of Mortgage Loans in Forbearance Dips to 4.49%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed little movement from the previous week. MBA said loans now in forbearance decreased by 1 basis point to 4.49% of servicers’ portfolio volume as of Apr 18 from 4.50% the prior week. MBA estimates 2.25 million homeowners are in forbearance plans.