For nearly one-third (31%) of millennial first-time homebuyers, the ability to save extra money during the coronavirus pandemic helped them accumulate the money needed for a down payment, said Redfin, Seattle.

Category: News and Trends

Quote

“Mark [Jones] is a fierce advocate for mortgage lenders and their customers…He is an industry trailblazer and a valuable voice for sustainable, affordable housing and communities across the country, making him a terrific fit to lead MBA and its members.”

Susan Stewart, MBA 2021 Chair and CEO of SWBC Mortgage, San Antonio, Texas.

Tom Lamalfa: May 2021 MBA Spring Conference Survey

In early May I surveyed 33 senior executives from 33 separate mortgage companies about a myriad of issues and topics both germane and important to the mortgage banking industry. It was the 25th time such a survey was conducted by me since 2008.

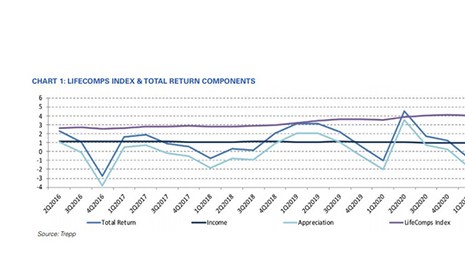

Life Insurance Commercial Mortgage Return Index Dips

Trepp, New York, said commercial mortgage investments held by life insurance companies dipped in the first quarter after three consecutive positive quarters.

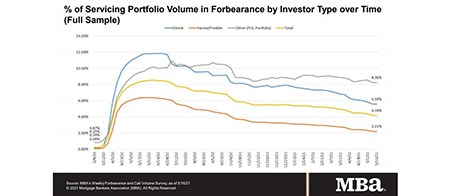

MBA: Share of Mortgage Loans in Forbearance Decreases to 4.19%

Mortgage loans in forbearance fell for the 12th consecutive week, the Mortgage Bankers Association reported Monday.

Omar Jordan of LenderClose on the Evolving Home Equity Loan Market

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that quips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations.

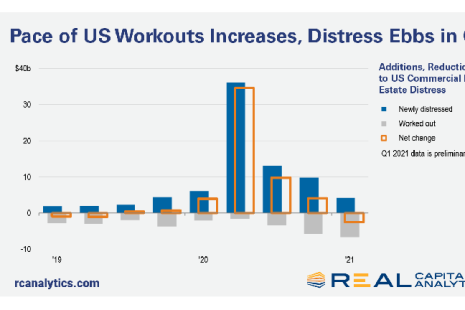

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

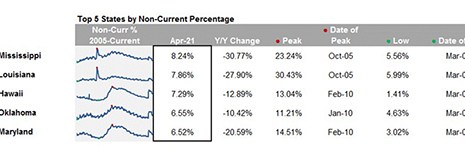

Black Knight: Delinquency Rate Falls Below 5% for First Time Since Pandemic

Black Knight, Jacksonville, Fla., said the national mortgage delinquency rate fell by more than 7 percent in April to below 5 percent for the first time since onset of the coronavirus pandemic.

MBA Asks 6-Month Delay of Debt Collections Proposed Rule Effective Date

The Mortgage Bankers Association, in a May 19 letter, asked the Consumer Financial Protection Bureau to delay the effective date of its final rule amending the Fair Debt Collection Practices Act.

FHFA Announces GSEs’ Proposed Duty to Serve Underserved Markets Plans for 2022-2024

The Federal Housing Finance Agency published proposed 2022-2024 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac under the Duty to Serve program. The proposed Plans cover the period from January 1, 2022 to December 31, 2024.