Black Knight: Delinquency Rate Falls Below 5% for First Time Since Pandemic

Black Knight, Jacksonville, Fla., said the national mortgage delinquency rate fell by more than 7 percent in April to below 5 percent for the first time since onset of the coronavirus pandemic.

“As the economy gets back on track, we’re churning through a lot of the distressed inventory of mortgages,” the company’s monthly First Look Mortgage Monitor said. “At the current rate of improvement, overall delinquencies should be back to pre-pandemic levels by the end of 2021.”

The report noted new 30-day delinquencies rose by 23% from March’s record lows, but were still down 33% year-over-year. At the same time, more than 400,000 (14%) ofhomeowners past-due on their mortgages became current on payments in April.

The report said serious delinquencies (loans 90 or more days past due but not yet in foreclosure) also saw strong improvement (-151,000 month over month), but nearly 1.8 million such serious delinquencies remain, four times as many as there were prior the pandemic.

Mortgage prepayments fell nearly 23% in April to their lowest level since May 2020. Other report highlights:

–Total Loan Delinquency Rate (loans 30 or more days past due, but not in foreclosure): 4.66%, down by 7.11 percent from March and by nearly 28 percent from a year ago.

–Total Foreclosure Pre-Sale Inventory Rate: 0.29%, down by 6.29 percent from March and by 28.67 percent from a year ago.

–Foreclosure Starts: 3,700, down by 26 percent from March and by 50 percent from a year ago.

–Properties 30 or more days past due, but not in foreclosure: 2.5 million, down by 172,000 from March and by 900,000 from a year ago.

–Properties 90 or more days past due, but not in foreclosure: 1.768 million, down by 151,000 from March but up by 1.306 million from a year ago.

–Properties in foreclosure pre-sale inventory: 153,000, down by 9,000 from March and down by 58,000 from a year ago.

–Properties 30 or more days past due or in foreclosure: 2..653 million, down by 181,000 from March and by 959,000 from a year ago:

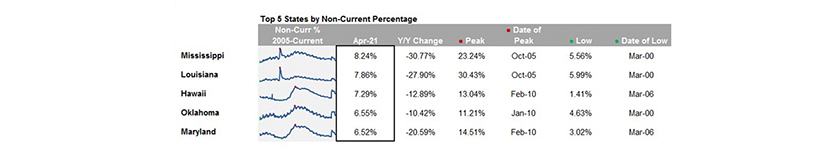

–States with the highest percentage of non-current mortgages: Mississippi, Louisiana, Hawaii, Oklahoma, Maryland.

–States with the lowest percentage of non-current mortgages: Idaho, Colorado, Utah, Washington, Montana

–States with the highest percentage of 90-day-plus delinquencies: Mississippi, Louisiana, Nevada, Hawaii, Maryland.